With the historic low interest rates and more pre-qualified buyers with attractive offers, houses are virtually flying off the market in almost every state in the United States.

The recent data by Realtor.com shows that between April 2020 to April 2021, the median home price has risen by an average of 17.2%. This frenzy has led more and more buyers & sellers to question whether this growth is sustainable for the near future. However, this rapid uptick in the housing market comes as a positive trend for local and state governments struggling with some of their revenue streams impaired by COVID-19.

In this article, we will take a closer look at the current housing market trends, the outlook and how it will likely impact both local and state governments.

Be sure to check out our Education section to learn more about municipal bonds.

An Increase in Property Tax Assessments

Since the pandemic, the increase in demand for homes caused a drastic decline in home inventories, and in turn, listing prices have climbed drastically. This trend has continued throughout the first four months of 2021, due to the pandemic-fueled desires of people wanting a new home coupled with continued low-interest rates. The continued increase in property values can be a lifeline for local and state governments, previously struggling with a decline in other revenue sources, like sales tax and transient occupancy tax, related to local tourism.

The property tax revenues are generally one of the largest revenue streams for all local and state governments, and it’s a revenue source that’s directly tied with the property value in any given jurisdiction. The recent rapid rise in the property values can directly and inevitably translate into higher property tax revenues for all local and state governments – and more importantly, this single revenue source was not impaired during the COVID-19 pandemic.

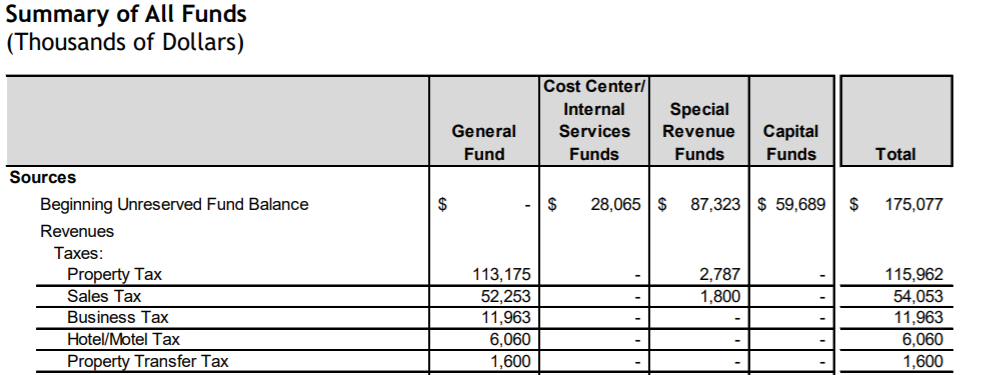

The diagram below shows the highest revenue sources for the City of Fremont, CA, with property tax being the top contributor to General Fund, and this picture is representative of many other cities around the U.S. with the large revenue sources being the same:

Source: City of Fremont, CA Budget Book 2020-2021

In the midst of this historic growth of home prices, many skeptics have started sounding the alarms of the current growth being too similar to the housing bubble of 2008 and how it all ended; however, many economists have refuted this argument by highlighting the strength of the mortgage industry and strict mortgage qualifying criteria will keep the housing market strong, with tapered growth in the upcoming years.

Understanding the Suitability of the Current Housing Price Growth

As aforementioned, one of the leading causes of the current growth is the low interest rate environment, which has contributed to the ability to take out a slightly higher mortgage and still afford the mortgage payment, which may not be possible in a 4 or 5% interest rate environment. The cities and other local governments not only depend on the existing housing supply but also work with home developers to construct new homes and increase the tax base – this is also a leading indicator for measuring the financial success of many local governments. During the current times, we are also seeing many first-time home buyers and investors leaving the confines of large cities and choosing to invest in small- to mid-size cities, which can exhibit two great signs of local economic growth:

- Influx of people with spending power, and

- Purchase of a home that will lead to a growth in the city’s tax base.

Although all these can be good signs and help the market return to normalcy, some skeptics are calling this the second housing market bubble of the 21st century. The recent data presented by Realtor Trends states, “New regulation in the wake of the last calamity has ensured that only the most qualified borrowers can get mortgages and the riskiest loans, such as subprime mortgages, are largely no longer available to the masses. Today’s buyers may be paying top dollar, but they’ve been vetted to ensure they can afford their mortgages.”

Be sure to check out this article to know more about municipal bond due diligence process.

The Bottom Line

Although a sustained long-term rapid growth of the housing market is not likely, we are likely to witness the settling of the current frenzy that may foster organic growth for the foreseeable future.

Another important distinguishable factor of the current market, from the 2008 housing market crash, is the drastic change in the workplace – from completely remote work schedules to a more modernized approach to the workplace. With that, many Millennials are choosing to settle in relatively remote areas from large cities that have and will foster new growth for these communities and lead to an increased tax base.

Sign up for our free newsletter to get the latest news on municipal bonds delivered to your inbox.

Disclaimer: The opinions and statements expressed in this article are for informational purposes only and are not intended to provide investment advice or guidance in any way and do not represent a solicitation to buy, sell or hold any of the securities mentioned. Opinions and statements expressed reflect only the view or judgement of the author(s) at the time of publication and are subject to change without notice. Information has been derived from sources deemed to be reliable, the reliability of which is not guaranteed. Readers are encouraged to obtain official statements and other disclosure documents on their own and/or to consult with their own investment professionals and advisers prior to making any investment decisions.