According to investment manager Lord Abbett, the municipal bond market outlook appears positive midway through 2023, driven by factors such as the anticipated cessation of interest rate hikes by the U.S. Federal Reserve, moderating inflation, and an improving supply-demand dynamic. These developments are expected to make municipal bonds more attractive to investors seeking tax-free income, notwithstanding persistent uncertainties related to inflation and potential market crises.

The Federal Reserve’s projected pause in rate hikes, coupled with signals of decelerating economic growth and easing inflation, may bode well for municipal bond market performance and fund flows. Higher yields on municipal issues offer investors a chance to secure appealing return prospects, providing a buffer for total returns that could be beneficial in the face of potential economic downturns.

Recovery in demand and an uptick in mutual fund inflows are predicted as rate volatility diminishes. Despite recent trends of negative mutual fund flows, the decrease rate is slower than the previous year. Supply has been somewhat limited to date this year, attributed to issuers postponing market entry due to elevated interest rates and substantial reserves. However, a catch-up in supply is anticipated in the second half of the year.

Concerns regarding potential oversupply from regional bank failures and subsequent muni holdings sales are not foreseen to pose a significant problem. The assertion is that the market can adequately absorb these portfolios. Even if the failed banks’ total municipal holdings were incorporated into this year’s supply, it would remain substantially less than the total municipal issuance of the previous year. This situation’s potential impact on the broader market performance is likely to be limited due to the distinctive low coupon structure of the banks’ holdings.

Municipal Bond Strategy Scorecard

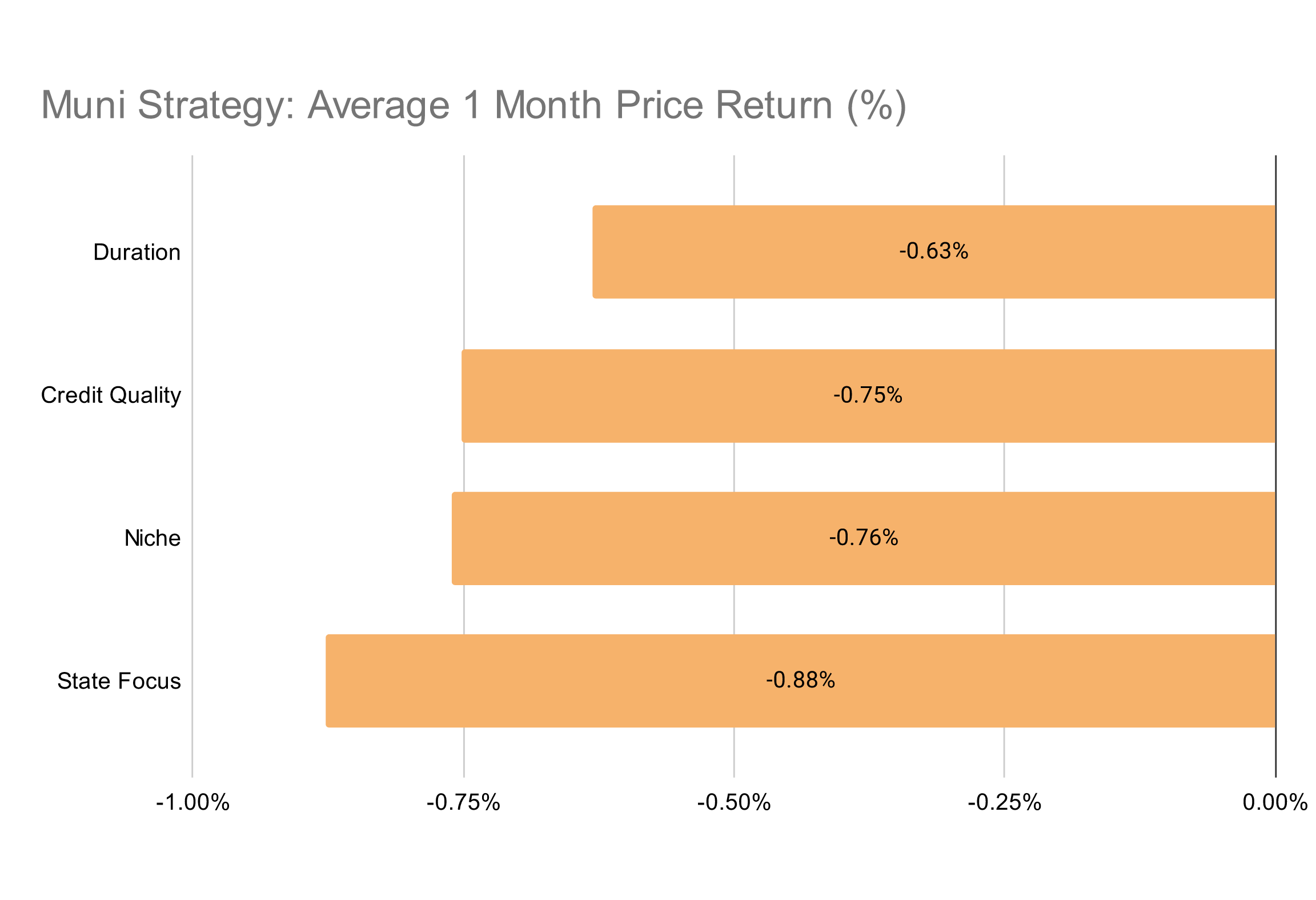

Overall, shorter duration and higher credit quality-based strategies outperformed several high-yield and tactical muni strategies in the trailing one month.

Duration Strategies

Shorter duration muni strategies continue to perform better than intermmediate duration based strategies over the trailing one month.

Winning

- PIMCO Short Term Municipal Bond Active ETF (SMMU) , up 0.32%

- Allspring Ultra Short Term Municipal Income R6 (WUSRX) , up 0.11%

- SEI Short Duration Municipal Fund F (SUMAX) , up 0.11%

Losing

- Thornburg Intermediate Municipal Fund C (THMCX) , down -1.26%

- BlackRock Short-Term Municipal Fund Investor C (MFLMX) , down -1.22%

- Baird Core Intermediate Municipal Bond Institutional (BMNIX) , down -1.14%

Credit Quality Strategies

Conservative high-quality muni credit strategies continue to outperform high-yielding strategies over the trailing month.

Winning

- Fidelity Flex Conservative Municipal Income Fund (FUEMX) , up 8.02%

- Baird Municipal Bond Fund Institutional (BMQIX) , up 0.12%

- PGIM Short Duration Muni Fund R6 (PDSQX) , flat 0%

Losing

- Nuveen California High Yield Municipal Bond Fund I (NCHRX) , down -1.49%

- AB High Income Municipal Portfolio Advisor (ABTYX) , down -1.46%

- PIMCO Municipal Bond Fund I-3 (PMUNX) , down -1.45%

Niche Strategies

Among niche strategies, strategies focused on diversifying risk, especially those involving both muni and equity securities, performed better than some tactical pure-play muni strategies.

Winning

- Federated Hermes Muni & Stock Advantage Fund F (FMUFX) , up 0.53%

- Columbia Strategic Municipal Income Fund Adv (CATRX) , up 0.1%

- Sierra Tactical Municipal Fund Institutional (STMEX) , down -0.31%

Losing

- Aspiriant Risk-Managed Municipal Bond Fund (RMMBX) , down -1.36%

- Pioneer AMT-Free Municipal Fund A (PBMFX) , down -1.3%

- Counterpoint Tactical Municipal Fund C (TMNCX) , down -1.25%

State Focus Strategies

Several California focused muni strategies emerged as winners in the trailing one month, while a handful of Kansas focused muni strategies struggled.

Winning

- IQ MacKay California Municipal Intermediate ETF (MMCA) , up 0.36%

- PIMCO New York Municipal Bond Fund I-3 (PNYNX) , up 0.08%

- Eaton Vance California Municipal Opportunities Fund A (EACAX) , up 0.07%

Losing

Methodology

Every month, we provide a snapshot of the performance of key muni bond focused mutual funds and ETFs to highlight the trending investment strategies across different segments of the broader muni market. We scan through hundreds of relevant muni bond focused mutual funds and ETFs. Fund performance data is calculated for the trailing one month, based on change in NAV.

Here is a summary of different muni bond strategies covered in this article:

- State focus strategies typically focus on muni bonds issued within specific states like New York or California. They can also include muni national bonds, which can be issued by multiple states and local governments to fund public projects.

- Credit quality strategies focus on muni bonds either carrying a specific credit rating or a range of credit ratings from investment-grade to below-investment-grade, as determined by credit rating agencies like S&P, Moody’s and Fitch, among others.

- Duration strategies focus on muni bonds, which can be assessed based on interest rate risk. Duration is typically measured in years. As a general rule of thumb, higher the duration (aka the more you have to wait to get your coupons and principal), the more will be the drop in the bond’s price as interest rate rises. This strategy can cover a wide range of muni bonds, based on short to long time to maturity.

- Niche strategies focus on any strategy that are not covered in the previous 3 categories. Some popular muni stratgies include ESG, AMT-free, risk-managed and other tactical themes meant to capture unique opportunities.