Originally conceived as an economist Christmas joke, the Christmas Price Index tracks the items listed in the popular Christmas song “The Twelve Days of Christmas”. In the song, the singer’s “true love” keeps giving them Christmas gifts for 12 straight days. The true love has a strange interest in cumulative gift giving and only adds one new gift a day while repeating the old gifts of all the previous days.

The result: the singer ends up with 168 birds, 138 people dancing, and enough gold rings for two on each finger and toe. Apparently the lead economist at PNC thought this concept was amusing and used the basket of goods to judge price inflation over time.

The 12 Gifts of Christmas

As the days of Christmas continue, each of the previous items get added to the current day’s gifts. For brevity, I will only list the new gifts of Christmas. In fact, most Christmas Price Index calculations refer to the basket of goods without repetitions.

Day 1: A Partridge in a Pear Tree

Day 2: Two Turtle Doves

Day 3: Three French Hens

Day 4: Four Calling Birds

Day 5: Five Golden Rings

Day 6: Six Geese a-Laying

Day 7: Seven Swans a-Swimming

Day 8: Eight Maids a-Milking

Day 9: Nine Ladies Dancing

Day 10: Ten Lords a-Leaping

Day 11: Eleven Pipers Piping

Day 12: Twelve Drummers Drumming

The Christmas Price Index

The Christmas Price Index is fun because it tracks a stable basket of gifts (or goods, if you prefer) over time and shows how the prices change during good or bad economic times. The gifts that make up the index never change, which is a bit different than most economic indices—that add and replace goods in the basket to keep themselves relevant over time.

A few interesting trends have emerged over time within the Christmas Price Index with services increasing at a faster rate than goods. This is in line with the U.S.’s transformation to a service-based economy. So, the cost of hiring dancers or ladies and lords constitute a large part of the index—but it’s still no match for the cost of seven swans a-swimming. Their breeding pattern is not very predictable and hence often goes through supply “disruptions”.

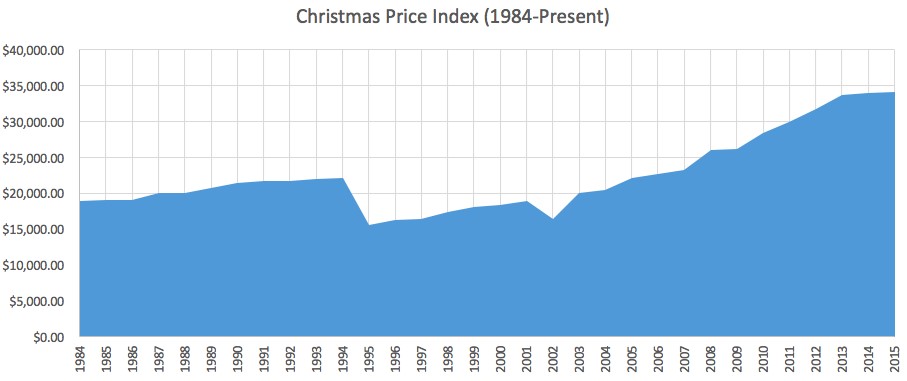

Overall, the price of the Christmas Index has been rising, and as you can see in the graph below, it has risen at a steady rate since its inception 32 years ago.

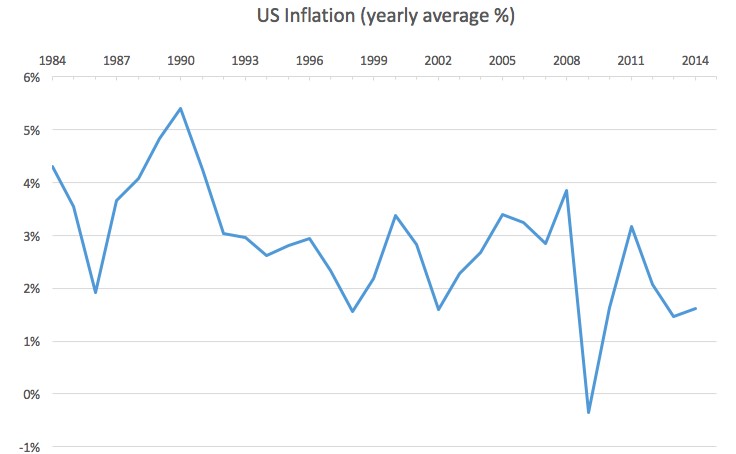

There are a few downward years, such as 2002, 1995, and 1988. Interestingly, consumer price index was still moving upwards- during these periods. Considering that the cost of swans (currently 38% of the index) probably caused these downward moves in the index value—take note! When buying your “12 days of true love Christmas presents,” (and God help you if you do), keep an eye on the movements of the swan prices. This is of course in addition to the shock value these presents will fetch you.

Consumer Price Index & Big Mac Index

The Christmas Price Index has increased 81% since 1984. The consumer price index on the other hand (which tracks many sectors like food, transport, housing, apparel, medical care etc.) during the same time has gone up by around 125%. Truthfully, there are just three sectors that all the gifts fit into: “food”, “recreation” and “other goods and services”. Together these sectors account for less than 25% of the consumer price index. In fact, in any economy, the housing sector alone accounts for most of the impact (more than 42% in CPI) which is altogether absent from the Christmas Price Index—so there aren’t a lot of useful comparisons between the two, except that both track a basket of goods. The main use of the Christmas Price Index is probably educational. It presents a fun way for students to learn concepts of basic economics and inflation.

It can be considered similar to the “Big Mac Index”, which is a great way to learn Purchase Power Parity. A Big Mac index measures how many Big Mac burgers you can buy for a fixed amount of money in USD. A lot of people who move to a new country make the mistake of converting the prices in the new country to their old currency, in order to judge whether something is expensive or cheap. They forget to account for the fact that they earn and spend differently in the new country and hence their “buying power” is now different. What they “used to pay” for the same thing in a different country might be a simple but not accurate way to look at it. Like Christmas, Big Mac is popular and can keep the economics 101 lesson fun and useful.

Merry Christmas and a Happy New Year!

Christmas is a time of family, friends and traditions—so now using PNC’s Christmas Price Index you can teach your kids a thing or two about how or why cost of living goes up every year (and why it’s not a bad thing entirely: A lesson on deflation perhaps?) Or maybe construct your own Christmas index and track that every year? Then you don’t have to go figure out the cost of swans every year. We hope you have a merry and joyful holiday with those you care about most. We will be here for you when the new year comes around. We hope you will use our wealth of data and insights to drive your winning investment decisions for 2016.