Emerging markets play an increasingly vital role in the global economy. For years, they have dazzled investors with high growth rates, expanding infrastructure and first-mover advantage.

While many of these advantages still exist today, emerging markets face strong headwinds in the form of uneven growth, geopolitical tensions and volatile commodity prices. These factors have made for a more challenging investment climate for income investors looking to generate consistent growth in a low-yield environment.

In reality, emerging markets cover a wide spectrum of nation states that are developing at uneven speeds and undergoing various transitions. India, China, Brazil and Russia – the foremost emerging market economies – are at different stages in their development cycle. For example, China is undergoing a major transition away from traditional growth drivers, such as investment and exports, and moving toward consumption and services. India, currently the world’s seventh largest economy, is expected to take China’s place as emerging market’s juggernaut, with growth rates well above 7% for the foreseeable future. Russia is buckling under the weight of a more than two-year oil-price collapse, while Brazil is slowly emerging from a generational recession that was exacerbated by a massive political scandal. This is the backdrop dividend investors must contend with when building their emerging market portfolio.

Before we delve deeper into these emerging markets, it’s important to provide a background about which types of companies pay dividends and whether these norms apply to the countries listed above. Before you begin, be sure to check out 40 Things Every Dividend Investor Should Know About Dividend Investing.

Common Characteristics of Dividend Stocks

Dividend paying stocks are an essential part of every well-balanced portfolio because they provide consistency, stability and exposure to industry-leading companies. Companies that are undergoing rapid growth and transition usually do not pay out dividends since profits are reinvested into the business for continued expansion. For these companies, paying a dividend is not feasible.

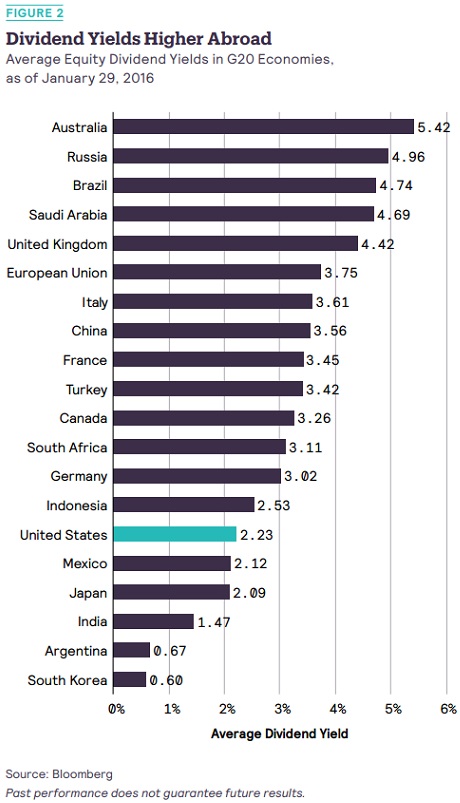

Using this rationale, it’s easy to see why many publicly listed U.S. companies pay out dividends. Industry stalwarts operating in a developed economy are in a better position to offer dividends to yield-seeking investors. On the other hand, many emerging markets companies that are partaking in their nation’s rapid growth and industrialization still have room to grow and are therefore less likely to pay out corporate earnings. However, it’s interesting to note that dividend yields are typically higher abroad than they are in the United States. This is true of both advanced and emerging markets stocks (you can check out the dividend yields of the G-20 economies here). For a list of foreign stocks that pay dividends, refer to the following page.

India

By 2030, India is expected to become the world’s third largest economy in terms of gross domestic product (GDP). It has already eclipsed China in terms of annual economic growth and is forecast to remain the fastest growing major economy for the foreseeable future. As such, Indian companies exhibit many of the same features as non-dividend payers still in the process of expansion. Additionally, the country’s corporate culture typically does not facilitate profit distribution to shareholders, making India a challenging market for dividend investors.

China

After decades of runaway growth, China is experiencing a broad cool-down as the economy transitions away from traditional growth drivers and toward consumption. The short-term side effects have been painful. The Chinese economy in 2015 expanded at its slowest rate in 25 years. Weak domestic and international demand has led to a deterioration of its trade picture, while a booming housing market is raising concerns about a massive property bubble. That said, China will remain the world’s second largest economy for the foreseeable future. As such, it is home to several dividend-paying giants. U.S. investors should tread carefully, however, given the ongoing devaluation of the yuan renminbi, which could slacken the value of dollar-denominated dividend payments.

Brazil

Latin America’s biggest economy has been in the throes of recession since 2014, as plunging oil prices and a massive political scandal undermined confidence and overall growth. The recession is widely regarded as the country’s worst in over 100 years. It has triggered nasty side effects, such as sky high inflation and credit downgrades. While the Brazilian economy is expected to return to growth in 2017, companies have been forced to slash dividends at an unprecedented rate. Although yields may be high, the payout cuts offer little room for growth.

Russia

The oil crisis, now in its third year, has accelerated Russia’s downward spiral. As one of the world’s largest energy producers, Russia’s economic realities have changed significantly over the past two years. While Russia is home to many dividend paying companies, these players have struggled to increase payouts during the recession. Russia’s perceived destabilization of neighboring Ukraine has also triggered a barrage of Western sanctions limiting Moscow’s ability to access credit and trade freely with the rest of Europe. These forces make Russian dividend plays less attractive for the time being.

The Bottom Line

As the lines between emerging markets and advanced economies become increasingly blurred, investors have a greater incentive to research dividend paying stocks. A detailed breakdown of dividend yields by industry is provided here.

As the preceding discussion illustrated, dividend payouts are less frequent in emerging markets. China stands out as the clear winner, but currency devaluation remains a chief concern. India offers attractive returns in terms of prospective growth, but has a culture that is less conducive to dividend payouts. Given their current economic realities, Brazil and Russia currently make poor plays from a dividend perspective.

The size and frequency of dividend payouts in emerging markets may soon change as these and other countries continue to expand and mature. For information on how to gain exposure to emerging market securities, refer to the ETFdb Country Exposure Tool.