Chinese junk-rated dollar bonds have seen their worst sell-off since the depths of the March 2020 pandemic. As regulators seek to curtail borrowing in the debt-laden property market, some investors worry that large defaults could pose a systemic risk to the economy. That said, most of the damage to date is limited to specific areas of the market.

Let’s look at what has led to China’s junk bond sell-off and what it means for the global financial system.

To learn more about different ways to generate income, visit our Fixed Income Channel.

Regulators Seek to Deleverage

China’s property developers account for nearly all of the increase in leverage among listed firms in China over the past decade, according to Capital Economics. While these companies have sidestepped government scrutiny in the past, the government’s so-called ‘three red lines’ could finally put an end to the industry’s debt binge.

The new ‘three red lines’ policy introduced new borrowing limits last August. Property developers face a 70% ceiling on liabilities to assets, a 100% cap on net debt to equity, and must have the cash to cover short-term borrowing. If companies breach any of these guidelines, the government promised to shut down onshore financing channels.

Initially, many property developers sidestepped these rules by forming joint ventures (JVs) that use off-balance-sheet financing to meet the strict requirements. However, earlier this year, analysts, investors, and rating firms became concerned about the impact of JVs on cash flows and the ability to sell hard assets to shore up liquidity.

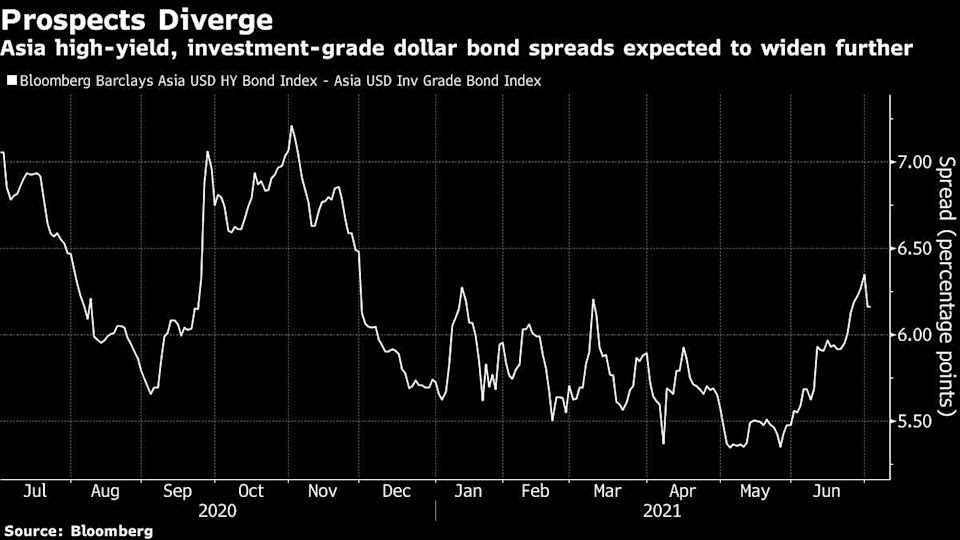

As a result of these trends, the spread between high-yield and investment-grade bonds has significantly widened between late May and late June (as shown above). The good news is that U.S. investors seeking greater yield may eventually be drawn into the market and provide some stability since investment-grade and junk bond yields have been converging there.

Want to know more about portfolio rebalancing? Click here.

Credit Risk Polarization

Overall asset quality at Chinese banks remains under control. For example, stressed loan ratios fell from 4.8% in 2019 to 4.2% in March 2021 due to faster loan growth and aggressive write-off policies. Furthermore, only certain provinces and sectors have experienced pressure thus far, meaning that the country’s other debt remains solid.

The Hainan, Liaoning, Hubei, and Tianjin provinces face the most pressure from the markets thus far, while local governments with less fiscal flexibility have more difficulty supporting local firms. And, to date, aggressive write-offs and securitizations at local banks have stemmed these issues and prevented a more widespread sell-off.

That said, dynamics could quickly change depending on the actions of the Chinese government. In May, the government said that it was “strongly committed” to making sure both foreign and domestic bondholders don’t receive full repayment of Haurong Asset Management’s principal following its financial woes.

Additional moves to pressure property developers that use off-balance-sheet funding sources could add pressure to already cash-strapped builders and curb property market growth. Of course, a slowdown in the property market could also adversely impact the broader economy, potentially pushing other bond yields higher.

Check out bond funds from different geographies here.

The Bottom Line

It’s no secret that China’s property developers are over-leveraged, but after years of evading government restrictions, many of these companies are finally deleveraging to meet new government requirements. Unfortunately, these trends have pushed high-yield bond prices lower, and several high-profile companies have defaulted on their payments.

For instance, Sichuan Languang Development Co. became the latest developer to miss a payment this year when it failed to repay a local bond. As the 38th largest builder in China by contracted sales in 2020, the default marks yet another casualty of the government’s deleveraging campaign and a potential sign of things to come.

Investors may want to steer clear of high-yield bonds in China as the government continues its crackdown but, so far, the pressure on bond prices has remained contained to a handful of areas of the market.

And don’t forget to visit our News section to catch up with the latest news about mutual fund performance.