Rising interest rates have reset the investment landscape. Bonds and other fixed income asset classes haven’t yielded much since before the Great Recession. Meanwhile, the potential for the Federal Reserve to cut rates has lit a fire under bonds as investors look to lock in high income. The combination could provide plenty of strong total returns.

Those reasons – among others – are why investment powerhouse, PIMCO is calling the new year, “prime time” for bonds.

For investors, following PIMCO’s lead and loading up on bonds this year could prove fruitfuln and provide even better returns than equities, as bonds enter a new long-term bull market.

Setting the Stage

We all know that inflation came back to roost in 2022. With the CPI hitting multi-decade highs, prices surging, and consumers struggling in the post-pandemic world, the Federal Reserve began the task of tackling inflation. And after zero percent interest rates since the end of the Great Recession, they began tightening. This has been one of the most aggressive rate tightening moves, sending benchmark rates from 0% to 5.5% today.

Naturally, bonds – with their inverse relationship – fell hard.

For fixed income seekers, this could be viewed as manna from heaven. Particularly, if they had new money to invest. Thanks to falling prices, yields on a variety of fixed income assets surged. Treasuries could be had for 4.5% and munis for 4%. Even corporate bonds and junk were yielding between 5% and 9%.

All of this made fixed income assets some of the best buys in years.

Still Great In 2024

Investors have responded to the cheap prices and high yields by buying. Overall, 2023 has been a good year for bonds – providing positive returns. Particularly now that the Fed has paused on its path of rate hikes.

But what about 2024? According to Pacific Investment Management Company – better known as PIMCO – the new year could be prime time for fixed income assets. That’s because relative to equities, bonds are a better deal.

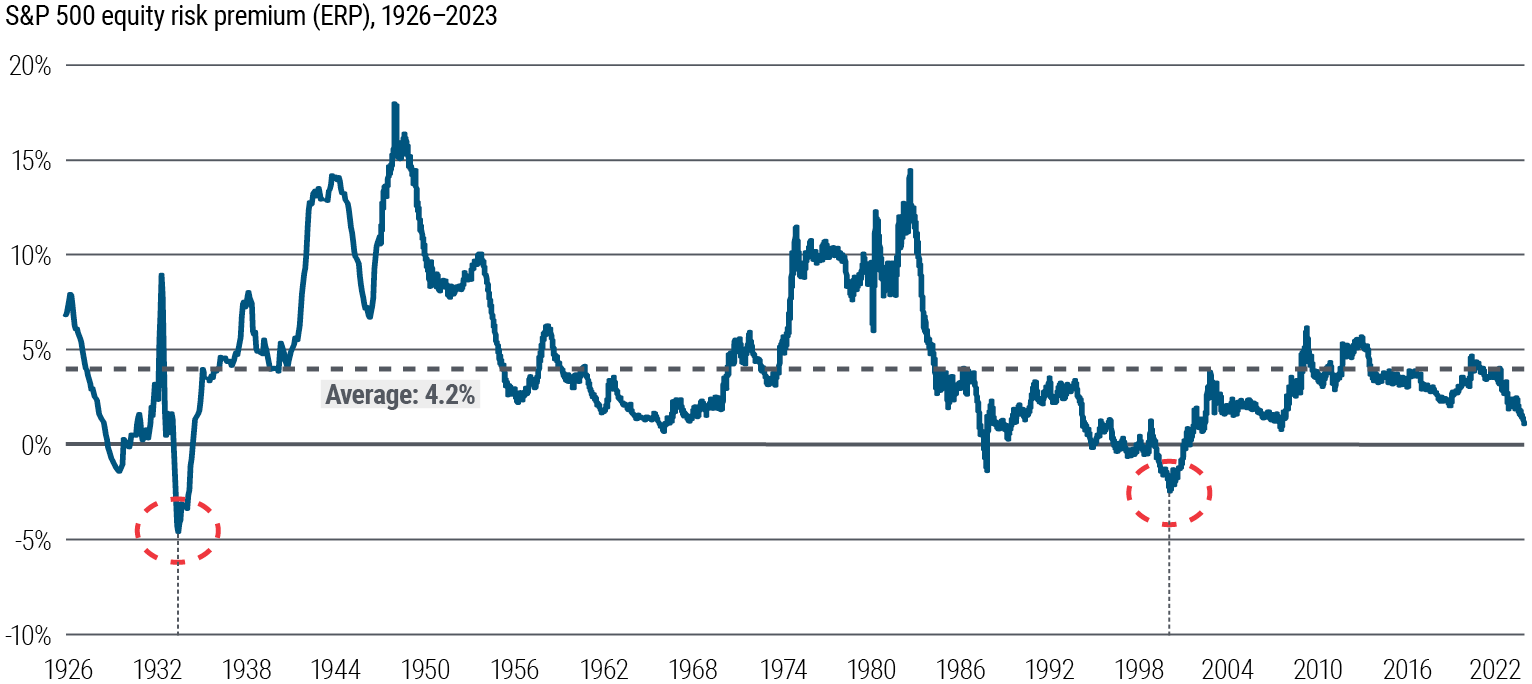

Valuations for equities relative to bonds are starting to get a bit stretched. The asset manager’s data shows that today’s equity risk premium (or ERP) is at one of the lowest points in decades. ERP can be calculated in a variety of ways, but PIMCO’s method uses the inverse of the price/earnings ratio of the S&P 500 minus the 10-year U.S. Treasury yield. With that, ERP is currently at 1%. That’s a low not seen since 2007.

Source: PIMCO

Digging further, there have only been a small handful of times when U.S. stocks have been more expensive relative to bonds, including the Great Recession and the dot-com crash. Reversion to the mean provides a bullish framework for fixed income assets.

Secondly, simple P/E valuations suggest lower equity returns. Looking at the last 20 years, the S&P 500 has traded at a forward P/E of an average of 15.4. Today, that forward P/E is over 18×. That valuation considers a 12% EPS jump for 2024. However, with the economy beginning to struggle, consumers and businesses clamping down, and other factors weighing on the economy, the EPS gains will need to be readjusted lower. 1

Finally, PIMCO suggests that rising overall volatility due to all the uncertainty favors bonds over stocks. Digging into VIX data versus equities/bonds, rising volatility has bonds outperforming. As investors look to reduce their risk, bonds should do well.

All of this is on top of the current high yields and potential for the Fed to make several cuts over the next year to fight off a slowing economy. This will have investors locking in income and boosting bond prices. The end all be all is that PIMCO predicts a wonderful 5% to 7% annual total return for bonds over the next five years. There’s a good chance that bonds could do even better – in the 7.5% to 10% range – annually over the next five years as well.

Buying Prime Time

With these factors in tow, PIMCO suggests that we haven’t had such a wonderful environment for fixed income in a long time, and now could be considered the prime buying opportunity for investors. That is, before the Fed officially pivots. Here, investors have the best opportunity to lock in yield and get ready for the sector’s total returns.

As specifics, PIMCO suggests high-quality bonds with longer durations as well as securitized assets: In a nutshell, intermediate Treasuries and corporate bonds, as well as mortgage-backed securities and collateralized loan obligations (CLOs). Luckily, there are plenty of ways to purchase these asset classes via ETFs. Moreover, active management could play a strong role in bond returns this year as managers can focus on better opportunities among the space.

PIMCO Bond ETFs

These ETFs were selected based on their exposure to PIMCO’s recommendations at a low cost. They are sorted by their 1-year total returns, which range from -8.8% and 9.2%. They have expense ratios between 0.15% to 0.58% and assets under management between $961M to $10.3B. They are currently yielding between 3.4% and 7.2%.

| Ticker | Name | AUM | 1-year Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| HYS | PIMCO 0-5 Year High Yield Corporate Bond Index ETF | $1.25B | 9.2% | 7.2% | 0.56% | ETF | No |

| MINT | PIMCO Enhanced Short Maturity Active ETF | $10.3B | 6.1% | 5.6% | 0.35% | ETF | Yes |

| CORP | PIMCO Investment Grade Corporate Bond Index ETF | $1.03B | 5.7% | 4.4% | 0.23% | ETF | No |

| MUNI | PIMCO Intermediate Municipal Bond Active ETF | $1.37B | 5.1% | 3.4% | 0.35% | ETF | Yes |

| LDUR | PIMCO Enhanced Low Duration Active ETF | $961.63M | 4.5% | 4.7% | 0.51% | ETF | Yes |

| BOND | PIMCO Active Bond ETF | $3.98B | 3.9% | 4.4% | 0.58% | ETF | Yes |

| ZROZ | PIMCO 25+ Year Zero Coupon U.S. Treasury Index ETF | $1.29B | -8.8% | 3.8% | 0.15% | ETF | No |

In the end, several important factors have made bonds wonderful plays for the new year. With these factors in tow, investors should consider loading up on bonds in the new year. Ultimately, they’ll have a great series of total returns going forward.

The Bottom Line

The shift in interest rate policy could be unleashing a prime time for bonds in the new year, according to a new PIMCO report. Several factors – including high current yields, low valuations versus equities, and overall economic deterioration – make bonds the top play for 2024.

1 PIMCO (November 2023). Prime Time for Bonds