Ever since their creation in the 1980s, high-yield or junk bonds have been used by investors to provide an interesting combination of income and total return potential. But, as their name implies, those higher yields do not come for free. Junk bonds have continued to be a volatile asset class – one that has many active managers struggling to find a foothold, despite the potential of credit research.

However, Fidelity may offer a solution to the problem.

By pairing junk bonds with stocks, it pulls them from the fixed-income sleeve and puts them into the equities side of the equation. While the move may seem counterintuitive, the concept is sound and can provide far less volatility and yet strong total returns. For investors, this could be the best way to have your cake and eat it too.

Junk Bonds as a Return Element

For most investors, bonds are seen as an income source – their steady coupon payments provide a source of return. And generally, with bonds, what you pay is what you get: a lot of investment-grade bonds, such as U.S. Treasuries, corporates, and munis trade close to par the bulk of the time.

However, junk bonds are different.

Just like you and me, bonds have various credit scores. Junk debt is the debt of the riskiest borrowers – rated Ba/BB or lower. Naturally, these riskier borrowers have a higher propensity for default. Historically, junk bond default rates have hovered between 3% and 5%, but, during periods of economic distress, that rate is closer to 8%.

As such, these bonds often come with higher yields. However, these bonds rarely stay close to their par values. Bonds that sink in the credit ratings or as default risks rise, values can swing wildly. The volatility of high-yield bonds is roughly double that of U.S. Treasuries.

Because of this, many investors look towards junk debt as a source of total return. The focus is both on yield and price appreciation when the bond finally matures or sees changes in its value.

This total return focus and the overall nature of the junk bond market lend themselves to active management. The idea is that managers can use credit research to find the best bonds for a total return.

However, according to Fidelity, many fall flat. Looking at high-yield managers’ returns, over the past 5 and 10 years, only about 28% and 11% of active managers have outperformed their benchmarks. Less than 10% of all managers have been able to outperform over both periods. 1

Reasons Behind Lackluster Manager Performance

The reason is twofold. According to Fidelity, a combination of security selection and costs hinders their outperformance.

Bonds are traded in the secondary over-the-counter markets. Here, prices are determined by a proverbial handshake rather than real-time pricing mechanisms like the NYSE or NASDAQ. For some bonds, like U.S. Treasuries, it’s not a big deal as the secondary market is large. But for most debt like junk bonds or municipal bonds, it can create wide bid/ask spreads. For the riskiest of debt, these spreads can be massive, potentially leading to losses on transaction costs.

The issue is that most high-yield managers tend to include or focus on the lowest-rated debt to help generate the best total returns. After all, bonds trading for pennies on the dollar have the highest yields and potential for gains when they are paid at par. However, lower-rated bonds offer more risk and lower returns than those on the higher rungs of the junk bond ladder.

A Better Solution

Fidelity offers an interesting solution to this problem of underperformance and higher risk. Get junk out of your fixed-income sleeve and consider it an equity allocation. Because junk is a total return element, it should be treated as such, meaning it is more stock-like than many investors consider. The best part is that investors can have better returns and lower volatility by doing this.

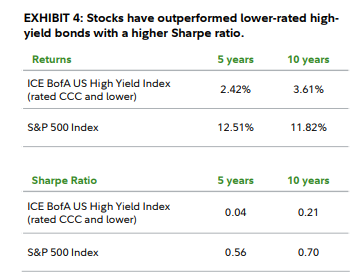

The key is to kick out the lowest-rated junk and replace it with equities. Looking at the data, the S&P 500 has managed to outperform the ICE BofA US High Yield Rated CCC or below index since the Great Recession – and they’ve done so at less risk. This table highlights the returns and Sharpe ratios for the asset classes.

Source: Fidelity Institutional

By pairing junk bonds of higher quality and equity together, investors can achieve a strong total return for their portfolios, while reducing their overall risks in either asset class. The coupons and high yields from junk bonds can smooth out returns, while the lower volatility of equities can smooth out the pricing issues with junk bonds. The combination can provide a better long-term return mix than going it alone.

The key to doing this is to consider junk bonds as a portion of your equity sleeve rather than lumping it in with your fixed-income assets.

The best part is that doing this is pretty easy. All it takes is a few ETFs. Taking a broad S&P 500 tracker like the SPDR S&P 500 ETF Trust or iShares Core S&P 500 ETF and buying a junk bond fund could be all you need. Fidelity doesn’t provide percentages on allocation as it feels that an active approach is better than a static one, but the higher returns/lower risk advantage is present at a variety of allocation points.

Junk Bond ETFs

These funds were selected based on their exposure to the junk bonds. They are sorted by their 1-year total return, which ranges from 10.6% to 12.6%. They have expenses between 0.05% and 1.02% and assets under management between $0.55B and $15.2B. They are currently yielding between 4.8% and 8.4%.

| Ticker | Name | AUM | 1Y Total Ret (%) | Yield | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| SRLN | SPDR Blackstone Senior Loan ETF | $4.6B | 12.6% | 8.4% | 0.70% | ETF | Yes |

| USHY | iShares Broad USD High Yield Corporate Bond ETF | $9.4B | 12.5% | 7.2% | 0.08% | ETF | No |

| SPHY | SPDR Portfolio High Yield Bond ETF | $1.36B | 12.5% | 8.0% | 0.05% | ETF | No |

| JNK | SPDR Bloomberg High Yield Bond ETF | $8.51B | 12.1% | 6.7% | 0.40% | ETF | No |

| HYLS | First Trust Tactical High Yield ETF | $1.54B | 11.8% | 6.5% | 1.02% | ETF | Yes |

| HYLB | Xtrackers USD High Yld Corporate Bd ETF | $3.93B | 11.9% | 5.8% | 0.20% | ETF | No |

| HYG | iShares iBoxx $ High Yield Corporate Bond ETF | $15.2B | 11.4% | 6.8% | 0.49% | ETF | No |

| PHB | Invesco Fundamental High Yield Corp Bd ETF | $0.55B | 10.6% | 4.8% | 0.50% | ETF | No |

In the end, junk bonds can be a wonderful addition to a portfolio. However, investors often get the allocation and focus wrong. They are total return elements and, as such, they should be treated as one. This means considering them similar to equity and adding them to a stock sleeve. The end all be all is reduced volatility and better returns over the long haul.

The Bottom Line

High-yield debt is often thought of as a way to boost yield. But it should be a total return element, with capital appreciation and income working together. This means it should be paired as a stock allocation. By doing so, investors have a better chance to lower their risk and boost their returns.

1 Fidelity Institutional (January 2024). High yield has shined. Most high-yield managers haven’t