The bond market has experienced a dramatic shift over the past few years. Since the 2008 financial crisis, the market value of A-rated bonds has fallen below that of BBB bonds. Low interest rates caused companies to raise capital on favorable terms while investors have shunned low-yielding investment-grade bonds in favor of high yield bonds.

Let’s take a look at how these trends have been exacerbated by the COVID-19 pandemic and what that means for investors in bonds.

To know more about fixed income concepts and trends, check out our Fixed Income Channel.

COVID-19’s Impact on the Market

The COVID-19 pandemic is projected to reduce the U.S. real gross domestic product by $7.9 trillion, or 3%, between 2020 and 2030, according to the Congressional Budget Office. Business closures and social distancing measures will continue to suppress consumer spending in the foreseeable future, while the drop in energy prices is likely to put a tight lid on investment in the energy sector.

While stock prices reached record highs, corporate earnings have suffered due to the pandemic. During the third quarter, S&P 500 index components are expected to report a 22.2% drop in earnings, marking the second largest year-over-year decline since Q2 2009 (-26.9%), although 43 of 65 companies issued positive guidance, according to FactSet.

The deteriorating corporate earnings outlook has exacerbated the shift from A-rated to BBB-rated bonds by causing a flood of fallen angels—or formerly investment-grade issuers that recently fell into junk status. The sudden influx of junk bonds could have significant repercussions for the market over the coming quarters.

Use the Dividend Screener to find high-quality dividend stocks based upon 16 parameters. Stocks with the highest Dividend.com Rating are Dividend.com’s current recommendations to investors.

The Evolving Bond Market Outlook

The impact of COVID-19 on the bond market depends on the post-COVID-19 economic recovery. While a swift rebound in consumer spending could create a V-shaped recovery, there are signs that consumer behaviors may not return to pre-COVID-19 levels—at least not immediately—especially until a vaccine is widely distributed.

Vanguard estimates that as much as $400 billion worth of BBB bonds could be at risk of downgrade to high-yield status in the U.S. due to the pandemic, which translates to about 6.5% of the $6.1 trillion investment-grade corporate market and nearly 14% of the $2.9 trillion BBB market, according to data from Bloomberg Barclays.

On the other hand, Blackrock projects that the volume of downgrades will be significantly lower than the last three periods of elevated downgrades, including the 2008 financial crisis. The asset manager attributes the lack of downgrades to the changing composition of the investment-grade bond universe, which includes more issuers in non-cyclical sectors.

Check out our latest Best Dividend Stocks List here.

Impact on Investors

The bond market could be an attractive place to find alpha over the coming quarters given the high level of market disruption. According to a Russell Investments survey, more than 60% of investment managers believe that U.S. high-yield bonds will deliver the best risk-adjusted returns over the next 12 months, although passive bond funds could become quite risky.

The downgrading of BBB bonds to junk status could force indexes to divest these bonds, putting downward pressure on the bonds’ prices. While traditional bond funds may be required to sell at fire-sale prices, actively managed funds may have an opportunity to preemptively take action and spare owners from the downside risk from fire-sale activities.

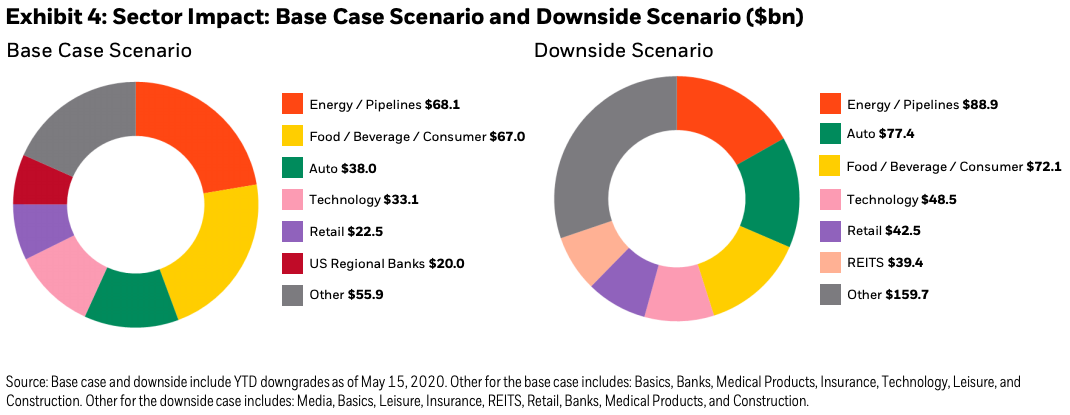

Sectors Impacted by COVID-19 – Source: Blackrock

The impact on individual issuers will vary based on the industry. Kraft Heinz, Ford, and Occidental Petroleum were recently downgraded, but these companies have very different levels of risk. Many fallen angels are also higher quality than other junk bonds, which means that junk bond funds could benefit from higher credit quality.

The Bottom Line

The COVID-19 pandemic has caused widespread disruption in the bond market as many BBB bonds are downgraded to junk status. With high-yield bonds already trading near record low yields, investors may find some opportunities to acquire these issuers at good prices, especially considering they tend to be higher quality than conventional junk bonds.

Be sure to check out Dividend.com’s News section for next week’s Market Wrap and other great dividend investing news.