Wall Street loves securitization. From credit card receivables to auto loans, investment bankers love to package various assets into bonds. One of the biggest of those assets classes over the last decade has been commercial mortgages. The sheer number of commercial mortgage-backed securities (CMBS) on the market is well over $1 trillion and the bonds are featured prominently in many bond funds.

However, some cracks have begun to form in CMBS’s armor.

Various factors—from declining property values to refinancing risks—are starting to make the CMBS market feel a bit shaky. Is this cause for worry or is there opportunity in the sector?

The Pandemic Loaded the Gun

First created in 1994, CMBS allow investors to profit from the steady rental income of various properties without actually owning the building. Essentially, a bank or lender packages various commercial mortgages based on creditworthiness and sells them to investors. This removes the loans from their books and keeps the flow of money for new loans growing.

The system had worked well until the pandemic. It’s no secret that COVID-19 flipped the script when it came to how we shop, work, and play. With more people working remotely and not visiting malls, office and retail space began to empty out. This trend has continued today as various office property hotspots like New York and San Francisco are being hit with mass layoffs from the tech and finance industries.

With that, property values have begun to drop and delinquencies have begun to rise. According to data firm Trepp, the office delinquency rate increased 125 basis points to 4.02% in May. To put that into context, the number hasn’t been above 4% since 2018 and was only 1.9% during the pandemic according to Fitch.

At the same time, the rise in interest rates poses a dual-edged issue as well.

For every payment you make on your home mortgage, part goes toward the principal and part covers the interest expense. However, that’s not the case with many commercial mortgages. Typically, borrowers will only make interest-only payments for the life of the loan and then pay off the principal balance at the end. Most don’t do that, but either sell the building at a profit or refinance the loan and continue making interest payments. Trepp’s data shows that interest-only loans make up 88% of the market, up from just 51% in 2013.

However, with rates rising and property values falling, this is a major issue. Both Trepp and Moody’s predict that many borrowers will have major refinancing issues over the next year, with $1.5 trillion worth of CMB debt coming due. That could increase delinquencies and foreclosures, and reduce property values even further.

For the holders of CMB bonds, this is a major issue.

Should Investors Worry?

For many investors, all of this sounds very much like the Great Recession, and for good reason. This is basically what happened with residential mortgages. Needless to say, the CMBS market has been very rocky since the end of 2022.

But there is some reason to be optimistic. For one thing, office debt makes up only 26% of all CMBS, while retail makes up about 24%. The remaining sectors—multifamily, industrial, and lodging—are being supported by strong tailwinds. Even retail is starting to come back as consumers look toward in-person shopping experiences.

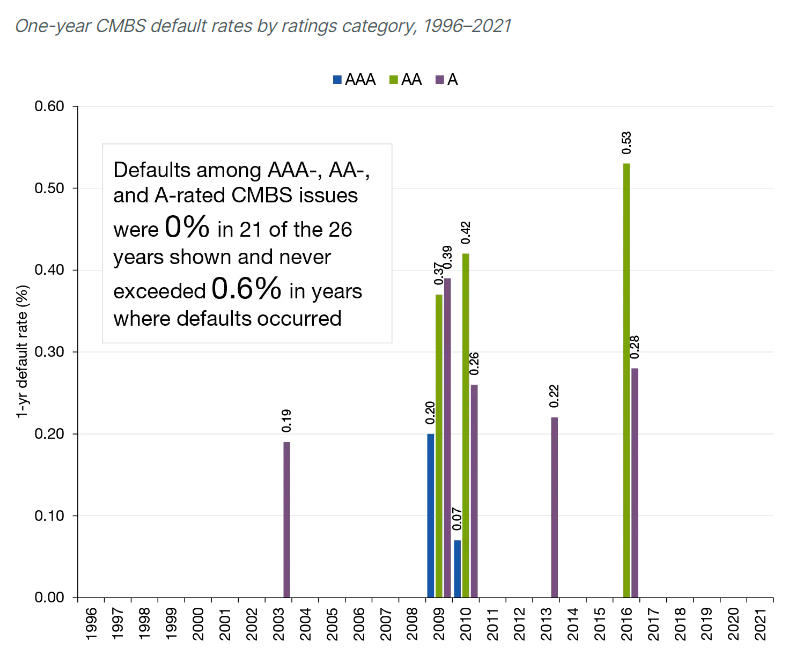

Second, even when it’s scary out there, CMBS defaults have historically been low. Data and this chart from Lord Abbett underscore how top-rated CMBS bonds perform, with a default rate of 0% for 21 out of the last 26 years.

Source: Lord Abbett

Finally, much of the sector’s problems may be backed in. With last years bond rout and this year’s current issues, CMBS are yielding close to 6%. Given the low default rates and asset-backed nature fo the bonds, that’s a very good deal.

A Risky, Yet Potentially Rewarding Play

For investors, the question is whether or not to dive in. The answer may be to ease into the water. The truth is there is still a lot of risk left in the CMBS market. And while historical data is on investors’ sides, this time could always be different. With that, adding a small slice of commercial mortgage-backed bonds could be the answer.

The easiest and most direct way could be the iShares CMBS ETF. The ETF tracks nearly 600 CMBS bonds. More than 87% of its holdings are in AAA-rated bonds and doesn’t hold any debt rated below BB. In fact, it holds less than 1% of its assets in BBB- and BB-rated CMBS bonds. With the ETF, investors score a decent yield of 3.81%.

Like many bond sectors, an active touch could prove better in the CMBS market. Analysts can find better deals, look at property types, etc. to find value. The new Doubleline Commercial Real Estate ETF (DCMB) offers one of the few funds that hones in on CMBS only. Most managers couple CMBS bonds with residential mortgage-backed securities (RMBS) in one fund. This could be a better bet. RMBS provides security, with CMBS providing extra spice. Both the JPMorgan Mortgage-Backed Securities Fund and PIMCO Mortgage-Backed Securities Fund offer two top-rated funds in the space that hold all manners of mortgage-backed bonds.

Here's a summary of the major CMBS funds on the market.

| Name | Ticker | Type | Active? | AUM | YTD Ret (%) | Expense |

|---|---|---|---|---|---|---|

| iShares CMBS ETF | CMBS | ETF | No | $726 million | 1.6% | 0.25% |

| RiverPark Floating Rate CMBS Fund | RCRIX | Mutual Fund | Yes | $35 million | 1.5% | 0.85% |

| JPMorgan Mortgage Backed Securities Fund | OMBIX | Mutual Fund | Yes | $4.05 billion | 1.2% | 0.4% |

| PIMCO Mortgage-Backed Securities Fund | PMRAX | Mutual Fund | Yes | $172 million | 0.5% | 0.92% |

The Bottom Line

Commercial mortgage-backed securities have long been a way for investors to juice their income, while providing exposure to commercial real estate. However, lately, the sector has been hit hard. While there is plenty of risk in the sector, those income seekers looking to spice up their portfolios may find CMBS bonds compelling. However, it may make sense to keep this strictly as a satellite play.

Don’t forget to check long-term muni bond funds to explore all funds.