For many investors, the allure of cash has been very strong over the last year. For one thing, as the Fed has continued to raise rates to combat inflation, cash and cash-like instruments such as T-bills have yielded between 4% and 5%. Meanwhile, those higher rates have continued to support a growing chance of recession, with economic data starting to deteriorate.

To that end, many investors are now overweight cash in their portfolios.

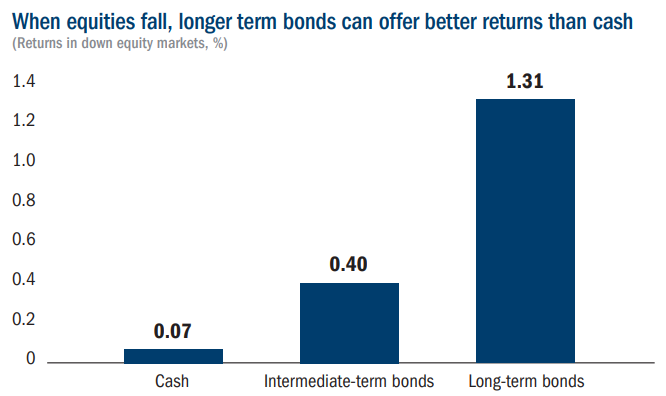

However, investors overweighting cash for safety may be doing themselves a disservice. It turns out that bonds may be a better hedge than cash when equities fall. That could mean moving from cash today for the eventual economic issues down the road.

High Yields Now

Investors are sitting on a lot of cash these days. In fact, they’re sitting on a record $5.5 trillion locked away inside money market funds. This doesn’t include savings, CDs, or other cash-like proxies. It’s easy to see why there has been a sudden rush to cash.

As inflation raged, the Federal Reserve has undergone one of the most aggressive tightening schemes in history. This has pushed rates from zero during the pandemic up to 5.5%. As such, cash once again started to pay some serious interest.

At the same time, those higher interest rates are usually harbingers of doom. Rising rates have started to take the wind out of the economy’s sails. A variety of metrics have started to drop, from consumer spending and labor to manufacturing and services demand. For many investors, sitting cash has brought comfort and protection from the potential declines.

And with the risk-free rate of cash now paying 5%+, investors are still broadly overweight cash in their portfolios. According to J.P. Morgan, those investors with moderate allocation models now have a cash weighting of 3.34% of their total. This is still above the recommended 1% to 2% for the risk allocation.

The Downturn Comes

With so much cash, investors are facing a real problem. When the downturn comes, they’ll be up the creek without the proverbial paddle.

When the recession does come, or even if it doesn’t and the economy starts to slow down, cash will be the first asset class to feel the pinch. That’s because the Fed will cut rates. As a very short-term instrument, the duration profile of cash allows it to change instantly with interest rates. So, that high yield on cash will fall very quickly indeed. This works itself out in two ways on the returns front.

For starters, there’s reinvestment risk. As rates are cut, longer maturing bonds—with their higher yields—will gain in price as investors look to lock in higher yields for longer. Those investors in cash will miss the boat and lose value gains/yield.

And while those staying in cash may see their volatility reduced, the returns on cash have historically underperformed inflation and have failed to generate any real return over the medium or long haul.

Bonds Are Better for the Downturn

While having some cash is important, being overweight is not necessarily a good thing for portfolios. Those hiding out in cash are doing themselves a disservice when it comes to the eventual downturn.

A better solution according to analysts at Columbia Threadneedle is bonds. Looking at the last 15 years’ worth of returns—which include the Great Recession and the COVID-19 pandemic—bonds have offered a better return than cash when equities fall. This chart from the asset manager highlights the return difference. 1

Source: Columbia Threadneedle

The reasons come down to reinvestment risk and locking in of yields. When downturns happen, the Fed quickly swoops in and cuts rates, making cash a losing proposition.

The best part according to the asset manager is that right now is the best time to buy bonds in a long time. After the Fed’s aggressive rate hikes, a variety of bonds across various risk profiles and durations are now yielding levels not seen since before the Financial Crisis. For example, buying high-quality bonds can lock in yields of 5% to 6%, while riskier bonds such as junk or bank loans yield 9% to 10%. This compares to yields of less than 2% for investment-grade debt and below 4% for junk of a year or so ago.

Investors don’t have to go too far out on the duration ladder to score high yields and take on too much additional risk versus cash. Short-term bonds—those with maturities of a year or two—are currently paying 4% to 4.5%, according to Columbia Threadneedle. That’s a good deal and it allows investors to own a good yield while still maintaining a cash-like profile. But even still, the entire bond world will be a better bet than holding cash when the downturn comes and equities fall. 2

The portfolio play is a simple one and a rallying cry that many managers are echoing. Get out of cash now and into bonds. Columbia recommends using bonds as part of an overall asset management strategy and that being overweight cash is not the way to go going forward. While the asset manager doesn’t provide too many specifics, a simple strategy can be created. Investors looking for cash-like low volatility can opt for short-term bonds, while those looking for similar or better yields than what cash is paying today can focus on other opportunities. Ideally, investors can do both.

Short-Term Bond ETFs

These ETFs are selected based on their ability to tap into short-term duration bonds at a low cost. They are sorted by their one-year total return, which ranges from 2.1% to 5.2%. Their expense ratio ranges from 0.03% to 0.56%, while they yield between 1.9% and 4.7%. They have AUM between $730M and $58B.

| Ticker | Name | AUM | 1-year Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| DFSD | Dimensional Short-Duration Fixed Income ETF | $1.55B | 5.2% | 3.9% | 0.18% | ETF | Yes |

| SPSB | SPDR Portfolio Short Term Corporate Bond ETF | $7.3B | 5.1% | 4.7% | 0.04% | ETF | No |

| FSIG | First Trust Limited Duration Investment Grade Corporate ETF | $731M | 5.1% | 4.6% | 0.56% | ETF | Yes |

| LDUR | PIMCO Enhanced Low Duration Active ETF | $989M | 4.9% | 4.7% | 0.51% | ETF | Yes |

| BSV | Vanguard Short-Term Bond ETF | $58B | 4% | 3.1% | 0.04% | ETF | No |

| SCHO | Schwab Short-Term U.S. Treasury ETF | $12.4B | 3.9% | 4.4% | 0.03% | ETF | No |

| SHY | iShares 1-3 Year Treasury Bond ETF | $26B | 3.8% | 3.5% | 0.15% | ETF | No |

| SUB | iShares Short-Term National Muni Bond ETF | $8.8B | 2.1% | 1.9% | 0.07% | ETF | No |

Investment-Grade Bond ETFs

These funds were selected based on their exposure to investment-grade bonds at a low cost and are sorted by one-year total return, which range from 2.5% to 6.9%. They have expenses of 0.03% to 0.25% and yields from 2.8% to 5.3%. They have assets under management between $880M and $59B.

| Ticker | Name | AUM | 1-year Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| NEAR | BlackRock Short Duration Bond ETF | $3.18B | 6.9% | 5% | 0.25% | ETF | Yes |

| SPBO | SPDR Portfolio Corporate Bond ETF | $886M | 4.3% | 5.3% | 0.03% | ETF | No |

| BSV | Vanguard Short-Term Bond ETF | $58.8B | 4% | 3.1% | 0.04% | ETF | No |

| SPTS | SPDR Portfolio Short Term Treasury ETF | $5.82B | 3.9% | 4.2% | 0.03% | ETF | No |

| LQD | iShares iBoxx $ Investment Grade Corporate Bond ETF | $27.9B | 3.7% | 4.3% | 0.14% | ETF | No |

| VTEB | Vanguard Tax-Exempt Bond ETF | $29.3B | 2.9% | 3% | 0.05% | ETF | No |

| GOVT | iShares U.S. Treasury Bond ETF | $23.2B | 1.1% | 2.8% | 0.05% | ETF | No |

| VCLT | Vanguard Long-Term Corporate Bond ETF | $6.44B | 2.5% | 5.2% | 0.04% | ETF | No |

Overall, the lesson is clear. Investors sitting in cash as a safety tool may be doing themselves a huge disservice when the downturn comes. The time to lock in yield is now. Whether they choose to be more opportunistic or stay short, the answer lies in bonds rather than cash. Right now is the best time to buy.

The Bottom Line

Investors’ cash holdings have surged on the back of safety and yield seeking. However, this is a huge mistake for portfolios. According to Columbia Threadneedle, bonds are the way to go. Offering higher yields and better returns, switching from cash to bonds is a no brainer.

1 Columbia Threadneedle (September 2023). Bonds could provide better diversification than cash in down markets

2 Columbia Threadneedle (January 2024). Locking in longer term yield