They don’t call them junk bonds for nothing. High-yield bonds have certainly earned their risky connotation over the years. Intended for borrowers of less-than-stellar credit quality, junk bonds feature higher default rates than traditional investment-grade fare. And with that, investors are paid a higher coupon.

But, the risks in junk bonds may be abating.

It turns out, junk bonds are getting less “junky”. Thanks to an improving credit quality of the sector as a whole, today’s junk bond sector has less risk than ever before. For investors, that’s a recipe for strong returns.

High Yield Gets Better

Just like you and me, corporations also have a credit score. And just like credit scores for people, firms are placed in categories based on their ability to repay their debts and the risk factors of the borrower. When it comes to bonds, there are two main categories: investment grade and non-investment grade.

A bond is considered non-investment grade if it has a credit rating below BB+ from Standard & Poor’s and Fitch or Ba1 or below from Moody’s. Because of their higher rate of default and bigger risks, investors generally demand higher coupon payments from these issuers. As such, high-yield bonds on average pay as much as 4 to 5 full percentage points more in yield than investment-grade bonds.

Back in the 1980s, investment bank, Drexel Burnham Lambert, launched the modern junk bond market by selling new bonds issued to non-investment-grade borrowers. Before that, non-investment-grade bonds were simply investment-grade firms who had fallen on hard times.

Interestingly enough, it’s this same phenomenon of investment-grade issuers slipping that could be making junk bonds less risky overall.

Fallen Angels Boost the Indexes

Thanks to the COVID-19 pandemic, the nature of the junk bond market has changed, according to a new white paper from Franklin Templeton. The asset manager suggests two factors have improved the overall credit quality of the sector.

For one, defaults have removed much of the “junk” from junk bonds. The pandemic created a wave of bankruptcies and defaults from the lowest credit-rated issuers. Back in 2020, the default rate for junk debt hit 4.0%, which is above the average long-term rate of 3.2%. You have to go all the way back to the Great Recession and 2009 to find a rate even close to the current numbers. By removing these firms, we’ve created a floor for credit quality.

At the same time, the top end of the junk bond market has improved. Thanks to the pandemic’s economic devastation, many investment-grade issuers fell into junk status. These bonds are called “Fallen Angels” and often sit at the highest levels of non-investment-grade ratings.

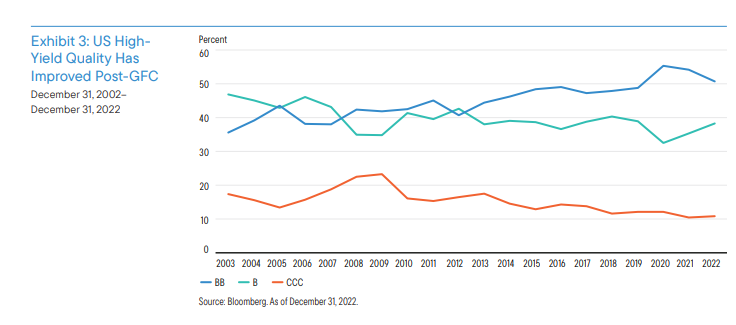

The combination of pandemic-era changes has improved the overall credit quality of the sector. Digging further into the high-yield market, Franklin Templeton shows that BB-rated bonds now comprise 50% of the market. Meanwhile, lower quality CCC bonds are at 10%, compared to the 40% and 20% weightings in the pre-Great Recession averages. This chart shows the improvement of the credit quality composition of the sector.

Source: Franklin Templton

Additionally, coverage ratios and lower interest rates have helped to improve the overall default picture of the sector. Thanks to years of low interest rates, many firms have locked in lower coupons for the long term. Coverage ratios, or the amount of liquidity available that can be used to pay interest expenses, are at all-time highs. Franklin also predicts that only 1.4% of high-yield bonds outstanding will need to roll over into 2025. Even so, the Fed has already signaled that its path of tightening may be over, and those roll overs will come with lower interest rates.

Finally, more firms have been turning toward senior loans rather than traditional high-yield bonds. Senior loans are secured by assets or equipment due to their borrower’s riskier status. Here again, this has removed many high-risk borrowers from the traditional high-yield market, improving the overall quality of the sector.

A Big Win for Investors

Thanks to the recent move by the Fed to increase interest rates, the drop in bond prices has pushed junk bond yields close to 8%. This is about 2 to 3 full percentage points higher than investment-grade bonds, without sacrificing too much in terms of credit quality. Remember, most of the high-yield bond index is now just below that investment-grade threshold.

This is all wonderful news for income seekers. With junk, they can score much higher highs and still have a bit of safety for their portfolios.

And luckily, there are plenty of ways to add junk bonds to a portfolio. Buying individually isn’t a great idea, as researching and buying individual issues can come with plenty of headaches. It’s best to buy them in bulk. Both indexing and active management can produce strong returns for the sector and allow investors to score high yields.

Junk Bond ETFs

These funds were selected based on their exposure to the junk bond sector and yields. They are sorted by their 1-year total return, which ranges from 7.5% to 11%.They have expenses between 0.05% and 1.27% and assets under management between $0.55B and $15.2B. They are currently yielding between 5.8% and 9.5%.

| Ticker | Name | AUM | 1Y Total Ret (%) | Yield | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| HYLS | First Trust Tactical High Yield ETF | $1.54B | 10.9% | 6.4% | 1.27% | ETF | Yes |

| USHY | iShares Broad USD High Yield Corporate Bond ETF | $9.4B | 8.6% | 6.7% | 0.08% | ETF | No |

| SPHY | SPDR Portfolio High Yield Bond ETF | $1.36B | 8.4% | 8.1% | 0.05% | ETF | No |

| JNK | SPDR Bloomberg High Yield Bond ETF | $8.51B | 8.1% | 6.7% | 0.40% | ETF | No |

| HYLB | Xtrackers USD High Yld Corporate Bd ETF | $3.93B | 7.9% | 5.8% | 0.20% | ETF | No |

| HYG | iShares iBoxx $ High Yield Corporate Bond ETF | $15.2B | 7.6% | 5.9% | 0.49% | ETF | No |

| PHB | Invesco Fundamental High Yield Corp Bd ETF | $0.55B | 7.6% | 6.2% | 0.50% | ETF | Yes |

| SRLN | SPDR Blackstone Senior Loan ETF | $4.6B | 7.5% | 9.5% | 0.70% | ETF | Yes |

Ultimately, junk bonds have improved and are no longer the risky asset class of yore. Although there is still a chance for defaults, these days, that chance is falling, making them a great income tool for all types of investors.

The Bottom Line

Thanks to improvements made during the pandemic, junk bonds are no longer considered very “junky”. For investors looking for income, the sector can offer plenty of yield without the previously associated high risks. Adding a swath of junk to your portfolio makes perfect sense going forward.