For many investors in today’s world, profitability is no longer the sole motivation of successful investing. Personal values tied to environmental and social causes are influencing investor behavior like never before.

Sustainable, responsible and impact investing (SRI) is a relatively new discipline that speaks to investors’ need to balance financial performance with core values. As an investment strategy, SRI considers environmental, social and corporate governance (ESG) criteria to generate sustained growth while maintaining a positive social impact.

The Growing Socially Responsible Investing Market

ESG criteria, as defined by MSCI, is outlined in the chart below:

| Environmentally Responsible | Socially Responsible | Responsible Governance | |

|---|---|---|---|

| Carbon Intensity | Affordable Real Estate | Board Flag | |

| Fossil Fuel Reserves | Education | Board Independence | |

| Water Stress | Major Disease Treatment | Board Diversity | |

| Energy Efficiency | Healthy Nutrition | Entrenched Board | |

| Alternative Energy | Global Sanitation | Overboarding | |

| Green Building | SME Finance | Shareholder Rights | |

| Pollution Prevention | Human Rights Violations | Fund Ownership | |

| Water Sustainability | Labor Rights Violations | Poison Pill | |

| Customer Controversies | Executive Compensation | ||

| UN Principles Violations | Accounting Flags | ||

| Catholic Values | |||

| Sharia Compliant Investing | |||

| Adult Entertainment | |||

| Alcohol | |||

| Gambling | |||

| Nuclear Power | |||

| Tobacco | |||

| Weapons Involvement | |||

| Firearms | |||

| Predatory Lending | |||

| GMO Involvement |

Click here to find ETFs screened based on the criteria listed above.

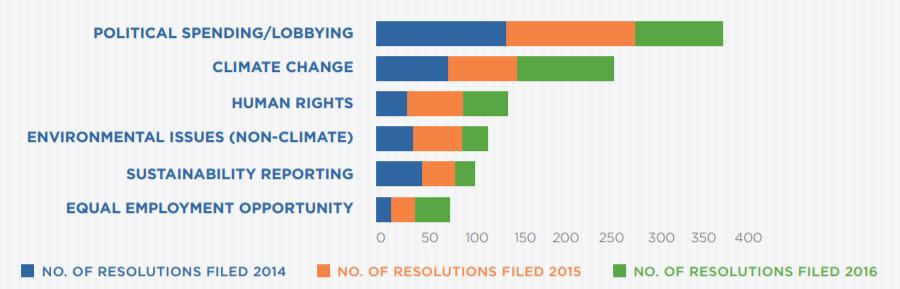

According to the U.S. SIF Foundation, SRI investments totaled $8.72 trillion or more by year-end 2015. That represents more than 20% of capital under professional management in the United States. SRI investing grew 33% between 2014 and 2016, with political spending and lobbying accounting for the largest share.

The following chart outlines the leading environmental and social responsibility proposals between 2014 and 2016:

Motivations for SRI Investing

SRI investing has many names, including “ethical investing,” “green investing” and “responsible investing.” Just as the names differ, so too do the motivations and strategies for entering this line of investing.

As the ESG chart illustrates, there are several motivations behind sustainable, responsible and impacting investing. The chief motivation is aligning one’s core values and goals with the financial performance of their portfolio. This strategy assumes that wealth creation and social good are not mutually exclusive but can be achieved in lockstep with one another.

For fund managers, SRI investing is largely driven by an underlying institutional mission and growing demand from clients.

SRI strategies usually entail investing in companies with strong corporate social responsibility governance or gaining exposure to funds focused on community development and clean technology.

Be sure check out our News section to keep track of the recent fund performances.

Pros and Cons of SRI Investing

Like any investment strategy, SRI initiatives have their fair share of advantages and disadvantages. Below is a brief rundown the main ones.

Pros

- SRI may give you the peace of mind knowing that your investment dollars are going toward a good cause. At the very least, SRI suggests that your money isn’t working to advance unethical business practices.

- Advances in technology and increased access to information have contributed to a large increase in SRI strategies. As the Forum for Sustainable and Responsible Investment notes, there are more than 456 mutual funds that meet the ESG criteria.

- As business and society become more ethically driven, strategies that employ SRI have a strong future profit potential. For example, recent data from Nielson found that nearly three-quarters of millennials would pay more for sustainable goods and services.

Cons

- Prioritizing SRI over other goals may hinder the performance of your investment portfolio, especially in the short term. If obtaining the highest return is your goal, SRI may inhibit your performance.

- Opportunity cost is another factor that needs to be considered when weighing SRI strategies. By focusing on ethically driven funds, you are leaving a lot of great investments on the table.

- Corporate social responsibility is a big deal on Wall Street, but there’s no single definition of what it means. What’s more, many funds and companies claim to be socially responsible when they are not. The time and research it takes to weed out socially responsible funds from those that claim to be can be inhibitive.

Learn here if ethical investing impacts investment returns.

Positive and Negative SRI Screening Approaches

Social screening – the process of selecting companies based on social or environmental performance – is the most common way to practice socially responsible investing. Social screening involves analyzing investments along various criteria, including avoiding military, alcohol, tobacco or gambling industries and selecting companies on the basis of their environmental track records.

There are generally two forms of social screening: positive and negative. Positive screening refers to the process of actively searching for companies or funds that reflect the investor’s underlying values. For example, investors who are concerned with environmental sustainability will actively seek out funds that produce clean technology.

Negative screening is the easiest form of social investing. As the name implies, negative screening is the process of avoiding companies or funds that do not cohere with an investor’s core values. Companies involved in the tobacco industry or that do not meet workforce diversity standards are often screened out by SRI investors.

Examples of broad-based ESG equity funds that survive both positive and negative screening include the Parnassus Core Equity Institutional Fund (PRILX), the Domini International Social Equity Institutional (DOMOX) and the Northern Global Sustainability Index (NSRIX). Investors seeking exposure to environmentally focused funds will find promise in the Calvert Global Water Institutional Fund (CFWIX) and the Pax Global Environmental Markets Institutional Fund (PGINX).

The Bottom Line

SRI strategies will only grow in importance as businesses, consumers and investors become more attuned to environmental and social causes. The jury is still out on whether these strategies can outperform the market or whether investors should expect a tradeoff between ethical investing and profits.

Signup for our free newsletter to get the latest news on mutual funds.