Environmental, social, and governance (ESG) funds have become increasingly popular over the past decade. In fact, global ESG assets grew more than 10% to surpass $1 trillion last year with nearly seven in ten retail investors interested in ESG products.

While investor interest is on the rise, inadequate issuer disclosures and a lack of consistent ESG metrics among asset managers has made it challenging for investors to implement the strategy in their portfolio and have confidence in their investments’ impact.

Let’s take a look at the current state of ESG disclosures, how institutional investors are influencing policy, what the U.S. could learn from other regions around the world, and what all of this means for retail investors that want to add ESG to their portfolio.

Explore our ESG channel to know more about ESG strategies and trends.

Current State of ESG Disclosures

The past decade brought an explosion of ESG indicators, disclosures, and metrics. The Global Reporting Initiative and the UN Guiding Principles Framework sought to evaluate the impact on high-level goals while the Sustainability Accounting Standards Board (SASB) and Task Force on Climate-Related Financial Disclosures (TCFD) focused on material financial issues.

Use the Dividend Screener to find the securities that meet your investment criteria.

SASB’s Materiality Map – Source: SASB

While these standards are certainly helpful, ESG disclosures by issuers are often inconsistent and incomparable, and material information isn’t always available. According to Global Reporting Initiative, an independent international organization that provides standards for sustainability reporting, fewer than one third of issuers around the world disclose ESG factors in a comprehensive and consistent way, while private U.S. companies (e.g., private equity-owned firms) are exempt from such disclosures.

Portfolio managers face related challenges. As with valuations and growth estimates, there are many different ways to assess ESG factors and the term is used to describe a wide range of strategies. An oil and gas company that’s investing in renewable energy may be included in one portfolio for its ESG activity and excluded by another for its exposure to oil.

Evolution of ESG Policy and Regulations

The Securities and Exchange Commission (SEC) has been reluctant to adopt ESG disclosure requirements. In early 2020, the agency’s proposed amendments to MD&A rules did not include requirements for ESG disclosures due to the complex landscape surrounding such disclosures and their forward-looking nature.

Despite the SEC’s inaction, public companies are facing mounting pressure from institutional investors to make ESG disclosures aligned with both the SASB and TCFD frameworks. BlackRock, Vanguard, and State Street are among the companies that have publicly called for these ESG disclosures to support their ESG-focused funds.

There has also been a lot of momentum in global ESG policy. The European Union introduced measures to standardize how sustainability measures are integrated into the financial system and introduced new ESG disclosure rules for investment managers in 2019. The European Securities Market Authority (ESMA) also rolled out its Sustainable Finance Strategy in 2020, which places sustainability at the core of its activities by embedding ESG factors in its work and introducing new disclosure requirements.

Implications for ESG Investors

Investors have many options when it comes to ESG-focused funds, but it’s important to realize that they aren’t all created equal. The lack of standardized ESG metrics means that investors should dig into the prospectus to identify the ESG scoring methodology and ensure that the techniques align with their personal ESG goals.

While BlackRock, Vanguard, and other large fund managers are pushing for changes to disclosure policy with their exchange-traded funds (ETFs), investors may also want to consider actively managed funds that prioritize active involvement in their portfolio companies. Typically, active fund managers would actually meet with management at companies to better understand their ESG goals, thus reflecting those strategies in the funds they manage.

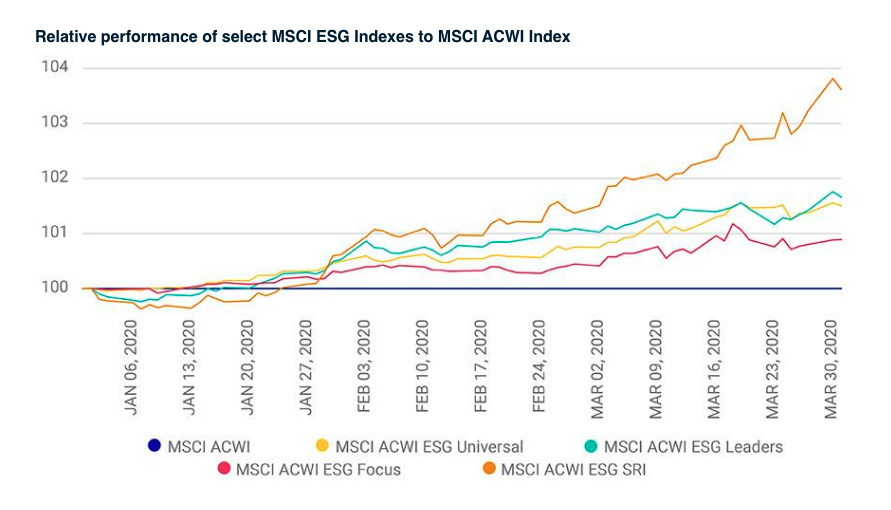

ESG Outperformance During COVID-19 – Source: MSCI

In the meantime, ESG indices, such as the MSCI ESG Index in the chart above, have outperformed conventional stock market indices during the COVID-19 outbreak, which means that they could have a valuable place in an investor’s portfolio.

Click here to explore the portfolio management channel and learn more about different concepts.

The Bottom Line

ESG funds are becoming increasingly popular among investors, and around the world, financial and securities regulators in more than 80 countries are working on ways to standardize how ESG information reaches investors. While the U.S. may be behind the curve with regulations, institutional investors have been pushing change forward in a positive direction.

Be sure to check our News section to keep track of the latest updates around income investing.