Arguably one of the biggest trends in the investment industry continues to be the exploration of environmental, social and governance (ESG) factors. Both institutional and individual investors have started to examine so-called “profits with a purpose.” That is, by analyzing how a firm treats its employees or how much carbon it emits, investors can align their personal values with their financial goals. Better still, research suggests that this approach does bare some serious fruit in terms of returns.

But like many aspects of the world, the recent pandemic has impacted the world of ESG and socially responsible investing (SRI). But in this case, the novel coronavirus has highlighted the style of the specific investing’s appeal.

For investors, the implications of the COVID-19 around the world of ESG are a positive one – and they could push the investing style more into the mainstream. At worst, it could mean better returns for your portfolio.

Don’t forget to check out this article to see how ESG and dividends could go hand in hand

“Walking the Walk”

The idea of SRI investing is an easy one to understand. The idea is to find not only the good companies but also those that “do good” to society or the environment. In the early days, it was as easy as getting rid of tobacco, firearms-makers, alcohol producers and gambling-related firms from larger indices. Today, SRI portfolios and indices are marked by a series of various ESG metrics. However, despite the recent surge in interest, much of ESG and SRI investing has been all talk. At least when it comes to shareholders vs. everyone else.

The so-called shareholder primacy model has served as capitalism’s driving force for decades. Here, the needs of the owners come first and other stakeholders fall behind. Even within the world of ESG, the shareholder primacy model held true. Corporations still weighed their decisions based on shareholder needs.

The coronavirus and resulting pandemic have sort of thrown that model on its head. The crisis has brought a lot of attention to the interconnectedness of multiple societal issues. Consumers and end-users are no longer willing to support those firms that strictly focus on profits over the health of their workers. Boycotts have been swift. Even corporations themselves have moved beyond simply PR actions and taken up the cause. Everything from the health of supply chains to carbon emission has now been placed under the microscope.

And the results are encouraging.

Those firms now “walking the walk” are doing much better than those that simply stuck to the shareholder primacy model. Two studies throw some light on the returns. According to a Harvard Business School Study, stocks of companies that used strong employee and supply chain practices managed to outperform their peers during the recent market drops. Between February 12 and March 24, when the pandemic hit, ESG-focused firms managed to outperform their peers by more than 2.2%.

Looking more broadly at the world of ESG-focused funds provides a similar outperformance. A study by Bloomberg and Morningstar show that ESG funds managed to outperform their non-ESG peers, while an MSCI study looked at bonds and found a similar relationship.

The realty is, firms that have looked toward really doing ESG – and not just for PR – are winning.

Looking Ahead

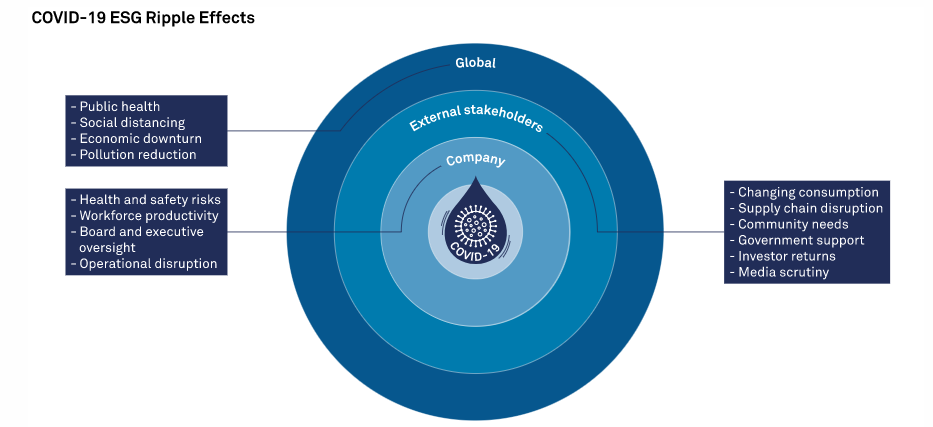

With the coronavirus shining light on ESG and providing extra returns for those practitioners, the metrics at which companies are evaluated could evolve as well. As illustrated by this graphic by S&P Global, there has been a real ripple effect across a variety of factors from the COVID-19 crisis.

Source: S&P Global

S&P breaks down the E, S, & G when it comes to the pandemic. According to the ratings agency, in light of the pandemic, more enthusiasm will be placed on social and governance standards. Environmental issues are one of the easier ones for companies to tackle. But with the pandemic putting the spotlight on workers’ health, the lack of health insurance and pay for front-line workers, social factors could now be a huge determinant in investors’ ESG criteria.

Be sure to check out our Portfolio Management section to know more different portfolio management concepts.

As could governance factors. Structure and oversight factors, as well as the quality of board governance, will be a major determinant in ESG rankings post-pandemic. For example, take a look at the case of Shake Shack (SHAK) and Ruth’s Chris Steak House (RUTH ). Both firms took advantage of the PPP government loan program, despite having thousands of employees plus the ability to raise stock and well-compensated c-suite executives. In the end, both the companies returned the money after they came under public presure.

As a result, it seems natural that going forward there will be a greater emphasis on governance standards of boards and c-suites, as well as social issues with regards to employees, suppliers and other stakeholders.

Wrapping It up for Investors

In the end, the COVID-19 pandemic has placed the spotlight on ESG. No longer are stocks able to just stick a SRI slide into their latest investor presentation and call it a day. They need to actually “walk the walk.” Consumers and other stakeholders are not willing to sit idly by. Going forward more attention will be placed on these metrics.

Those firms who have been playing along seem to be rewarded by the public. Through higher sales and stock prices, firms following ESG metrics have been passing by their non-ESG rivals. This should continue as the game has changed and ESG has become a mainstream portion of how a community evaluates a particular company.

As investors, it makes sense to look toward ESG in the post-coronavirus world.

Be sure to visit our complete recommended list of the Best Dividend Stocks.