Earning income from non-dividend paying stocks can be generated by using a strategy where you employ a synthetic dividend. This type of strategy can also be used to increase the returns you are already receiving on dividend paying stocks. Selling put options is a strategy that allows you to create a synthetic dividend as well as provides you the opportunity to dollar cost average to your ultimate entry price.

What is a Synthetic Dividend?

A synthetic dividend is a derivative product, created by using options. A derivative is a financial instrument that is derived from other instruments. There are two basic types of options: the put option and the call option. The buyer of a put option on a stock or ETF has the right, but not the obligation, to sell a stock or ETF at a specific price on or before a certain date. A call option provides the buyer with the right, but not the obligation, to purchase a stock or ETF at a predetermined price on or before a specific date. For more on call options, check out: How you can enhance your income play using covered calls.

Option Basics

The strike price of a put option is the price at which the underlying security can be sold. American style options allow the buyer to exercise options on or before a specific date, while European style options only allow the buyer of the option to exercise the option on the date when the option matures. The date when the option matures is called the expiration date. If the strike price of a put option is the same as the underlying price of a stock or ETF, the option is considered ‘at the money’ (ATM). If the price of the stock is below the strike price of a put option, the option is considered ‘in the money’ (ITM). Additionally, if the strike price of the option is above the current price of the stock or ETF, the option is considered ‘out of the money’ (OTM).

The price of an option is called the premium, and it is made up of two components. The first is intrinsic value, which calculates the value of the option that is in the money. For example, if the strike price of a put option on stock XYZ is $100 and the current price of the stock XYZ is $95, then the intrinsic value of the call option is $5 ($100-$95). The second component is called the time value of the option. The time value of option XYZ, with a strike price of $100, a premium of $6, and an intrinsic value of $5, is $1.

Selling Put Options

When you sell a put option, you are giving up the right to sell a stock, and for this you receive a premium. If the put option is exercised, you will be obligated to purchase the stock at the strike price. The risk you assume in a put selling strategy is that the price of the underlying stock falls, generating an unrealized loss.

Finding Attractive Puts

An option value is based on probability. The price of an option reflects the probability the stock will be in the money at expiration. This is determined by using implied volatility which is the market’s estimate of how much a security will move during the next year.

Generally, ahead of an earnings releases, the implied volatility of an option will rise, increasing the premiums buyers are willing to pay. Other events surrounding this period will also generate volatility. It’s important that you keep track of ex-dividend dates while playing options, as the increase in implied volatility around the ex-dividend date has an impact on put option prices. Keep track of all the stocks going ex-dividend in our ex-dividend date section.

At the time this article was written, the price of Facebook (FB ) shares was at $133, with earnings approximately nine days away. The implied volatility has increased, allowing you to sell an out of the money put option at elevated premiums. The $125 puts are bid (where someone is willing to purchase the puts) at $2.27 and offered (where someone is willing to sell the puts) at $2.31.

Since FB does not pay a dividend, the premium you receive when you sell the put option becomes a synthetic dividend. If you sell the put option at $2.31, the premium allows you to receive a cash flow that has a synthetic dividend yield based on the price of the underlying stock or ETF. In the case of Facebook, your initial dividend yield would be calculated by dividing the premium $2.31 by the cash or margin you posted for the option.

Understanding Payouts

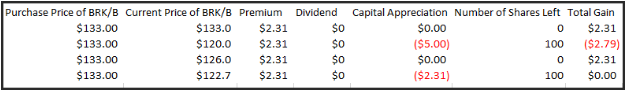

Here are a few scenarios that could occur with a put sale, using FB as an example. To illustrate, we are assuming you sold 1 options contract which exercises into 100 shares.

The stock price remains at the price where you sold your puts at $133.00.

- You would receive a premium of $2.31

The stock price moves below the strike price, to $120, and you are required to purchase the stock.

- Here you would receive your premium of $2.31.

You would also accrue a capital loss of $5.00 per share (the difference between your strike price and the present price is your capital loss $125 – $120.)

The stock price declines near the strike price, but remains above it, at $126.

- Here the option would expire worthless and you would receive the premium of $2.31.

Breakeven – the stock price drops to $122.69.

- Here you would own your stock and receive a premium of $2.31.

- You would also have an unrealized capital loss of $2.47, which is offset by the premium and the dividend.

The Bottom Line

By selling puts to produce a synthetic dividend you are taking a risk that the price of the stock or ETF will move lower, to generate a dividend payout. Stocks that produce a dividend will experience an increased return when adding a synthetic dividend. The benefits of receiving a synthetic dividend in the form of a premium not only protects you from declines in the price, but also allows you to dollar cost average at specific levels, while earning synthetic dividend income.

Corporate actions have a huge impact on stock prices which can alter put option pricing. Keep track of the latest corporate actions regarding dividends in our dividend payout changes page. Be sure to check out our dedicated section on options and dividends where we regularly cover topics related to options and dividend stocks.