Are you looking for short-term strategies that will allow you to enhance your dividend income? If so, then you should consider how you can earn income every week with weekly options.

Options Basics

If you recall, a call option is the right but not the obligation to purchase the shares of a stock or ETF at a specified price on or before a certain date. The price at which the option buyer can purchase shares is referred to as the strike price, while the date at which the option matures is called the expiration date. A put option provides the right to sell shares of a stock or ETF at the strike price.

When an Option Makes Money

A call option buyer makes money at expiration if the price of the underlying shares moves to a level above the strike price that accounts for the costs of purchasing the call option. For example, if you purchase XYZ $50 call that expires in one week for $1, the expiration price of XYZ needs to be above $51 ($50 strike price + $1 premium) for the buyer of the option to make money.

Weekly Options

The expiration date of listed options can vary. A relatively new and popular type of option is the weekly option. Weekly options get their name because these options have weekly expirations. In addition to listing weekly options that expire on Friday, the CBOE also has options that expire on Monday’s and Wednesday’s. The oldest type of options are monthly options that expire on the third Friday of every month.

Stocks that have both weekly and monthly expirations will not have a weekly expiration on the date in which there is also a monthly expiration. So on the third Friday of every month, there generally won’t be a weekly listed option that expires on a Friday.

Weekly options were introduced to provide investors with alternative expiration dates, to further promote the options market. You can now take advantage of news events that will potentially cause short-term price movements. Weekly options volume has grown to the point in which the weeklies account for approximately 40% of the total options volume on the S&P 500 index.

The Shares With Robust Weekly Volume

Volume statistic can change from week to week, but there are several large-cap stock names that have solid option volumes. Robust weekly options volume is important as it helps to determine liquidity.

Stocks that have robust weekly volume include:

- Apple

- General Motors

- ExxonMobil

- General Electric

When an option has hearty volume, the bid-offer spread is often narrow. The bid is where you want to buy an option and the offer is where you want to sell an option. The larger the bid-offer spread, the more expensive it is to trade an option.

Here’s an example. If a bid-offer spread of option XYZ is $0.20, then you would theoretically need to make at least $0.20 to break even. Stocks with robust weekly options volume can have bid-offer spreads as tight as $0.02. Generally, a narrow bid-offer spread describes a liquid stock option that provides traders the ability to easily enter and exit a position.

Generating a Synthetic Dividend

Weekly options can provide income to a dividend investor in several ways. The income you could generate is similar to a dividend in that you would receive premiums. If you are using weekly options to generate income, your payments would be on a weekly basis.

The two most efficient option selling strategies that can help you generate income are the covered call strategy and the put selling strategy.

Why Is Probability Important?

Option selling strategies take advantage of probabilities. The price of a call option incorporates the likelihood that the underlying stock will be above the strike price on or before the expiration date. This value is generated by an option pricing model, which helps to guide option sellers and buyers. The probability is based on an estimate by market participants of the future returns of a stock over the course of a year. This estimate is referred to as implied volatility. Options sellers benefit when implied volatility is high and can use elevated levels of implied volatility to receive rich premiums from selling options.

Charting Implied Volatility

A great guide to help you determine if implied volatility is rich or cheap is the VIX Volatility Index. This is a measure of the implied volatility of the “at-the-money” strike prices of the S&P 500 index. While it’s not the measure of weekly options, it will tell you when the overall market has elevated or depressed implied volatility. You might also consider finding a vendor who provides graphs of implied volatilities of individual stocks.

Technical Analysis

If you are looking to generate short-term income, you could use an overbought and oversold indicator such as the relative strength index (RSI) to help you initiate weekly options positions. Levels of an RSI above 70 are considered overbought, while reading below 30 are considered oversold. If a stock or ETF is overbought, you might consider selling call options. If a stock or ETF is oversold, selling a put option might be more prudent.

You should also consider combining technical analysis with your implied volatility analysis to fine-tune your strategy. For example, when the RSI on the VIX is below 30, implied volatility is considered cheap, and when it is above 70, it is considered rich. Remember, the best time to sell options is when implied volatility is relatively high. Therefore, even if you find a good weekly option candidate, make sure you believe you are selling options on that stock when implied volatility is relatively rich.

Understanding Payouts

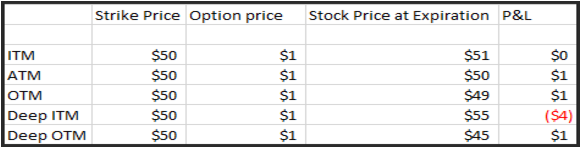

Here are a few scenarios that could occur if you sold a weekly call option on XYZ stock. You can learn more about option payouts in our dividend payout section.

- XYZ stock settles “in the money” ITM at $51 – the profit and loss is zero

- XYZ stock settles “at the money” ATM at $50 – the profit is $1

- XYZ stock settles “out of the money” OTM at $49 – profit is $1

- XYZ stock settles “deep in the money” Deep ITM at $55 – loss -$4

- XYZ stock settles “deep out of the money” Deep OTM at $45 – profit is $1

The Bottom Line

The bottom line is that weekly options offer dividend investors the opportunity to generate options premium income on a weekly basis. By using synthetic dividend strategies, you can receive income every week. Check with your broker about margin requirements for put/call writing before initiating any trade. It’s important to understand the downside to your trade before you initiate a transaction.