There’s nothing better than receiving income for doing nothing. And that’s basically what dividend investing is all about – getting a steady stream of payouts from simply owning shares of stock. But getting that steady stream of dividends isn’t as easy as picking the first ticker that pops into your head and pushing the “buy” button. It takes a little bit of know-how to ensure that the stock you choose will keep those dividends going for the long haul.

And while there are plenty of dividend metrics associated with dividend investing, there are four key ones that all dividend investors should be familiar with:

- Dividend yield: the dividend expressed as a percentage of a current share price.

- Payout ratio: the proportion of earnings paid to shareholders in dividends.

- Dividend growth history: the number of years a firm has steadily grown its payout.

- Annualized payout: the amount of dividends that investors receive out of a firm’s earnings over the course of a year.

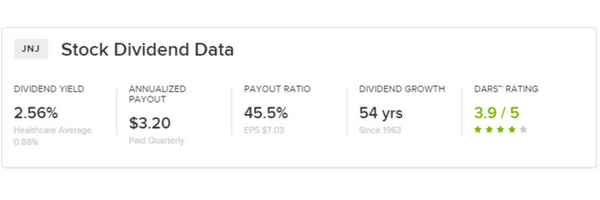

All of these metrics, along with our proprietary DARS scoring model, can be found near the top of each ticker page on Dividend.com and will be labeled “Stock Dividend Data.” They’ll look similar to this screenshot from healthcare giant Johnson and Johnson (JNJ ).

Today, we will be looking strictly at the annualized payout portion of our four core metrics.

What Is a Payout?

In simpler terms, a payout is what investors receive out of a firm’s earnings. When a company makes money through its underlying businesses, shareholders are entitled to a piece of that pie. It’s really what being a stockholder is all about. But, rather than have you go into one of their stores and take money out of the cash register, most firms will distribute those earnings back to investors as cash dividends. If you want more details about payout ratios and types of payouts, you can check out this handy guide.

The underlying idea is that a stock’s payout is driven by its earnings. Without profits, a stock can’t be handing back cash to its investors – at least not over the long run. And that’s key. By taking a firm’s payout and comparing it to its earnings for the same time periods, we can see how the two are related and how trend together. Are the earnings falling, but payouts rising? Are they going up together at the same rate? For dividend investors, it is important to make an apple-to-apple comparison.

What Is an Annualized Payout?

Annualization is standard in finance. When analysts look at stocks, indices or sectors, they need to have some sort of standard of measurement to gauge and compare two different securities. After all, company A is vastly different than company B. They have unique needs, cash flow/earnings profiles and their underlying boards don’t necessarily operate in the same way.

This all comes into play when looking at their dividend payouts.

As we said before, most stocks will pay out their earnings as cash dividends. These dividends are often quoted in a per share basis. For instance, it can be quoted something like “For X shares of XYX stock you own, you’ll receive $X in dividends.” Here in the United States, dividends are typically paid every quarter. However, some firms pay out their cash annually or semi-annually to shareholders.

The problem is the variability in payments throws off the apples-to-apple comparison when looking at earnings. For that reason, we tend to look at the annualized payout.

Calculating the annualized payout for a stock is quite easy. All investors need to do is take the amount of the dividend and times it by the period/frequency of the payout. So if a stock pays out $1 per share every quarter, its annualized payout would be $4. ($1 per quarter * 4 quarters per year).

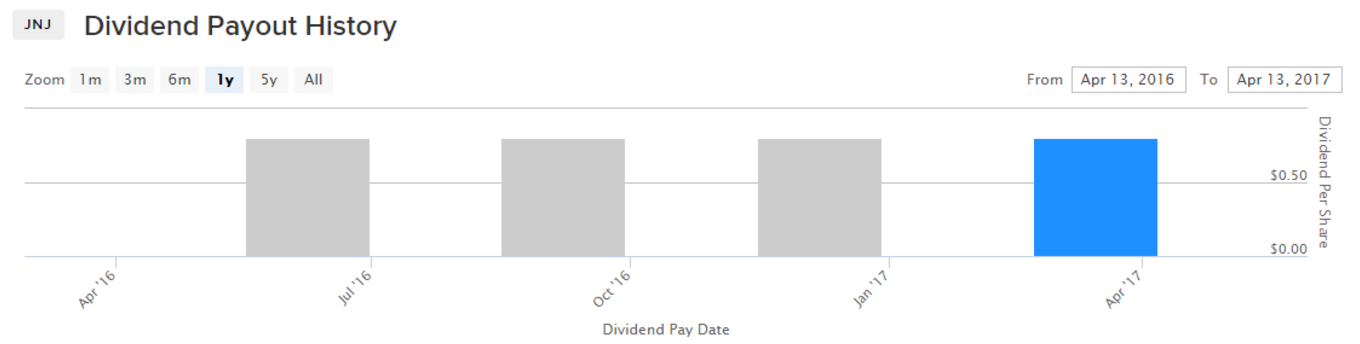

Let’s take a look at a real example. Below is JNJ’s payout history for the last four quarters.

As you can see, JNJ paid out 80 cents per share for each of the last quarters. Taking that as an annualized number, we get the $3.20 per share that is located in the Stock Dividend Data section of its ticker (80 cents * 4 quarters= $3.20). How management ultimately decides what and how much to pay is arbitrary; there are no hard and fast rules, but the payout is still mostly controlled by earnings per share. For the last four quarters, JNJ had earnings per share of $1.56, $1.65, $1.67 and $1.64, or about $6.52 for the entire year. So, JNJ is clearly earning more than it is paying out as dividends. A quick check of its payout ratio shows that.

You can find a stock’s earnings per share underneath the payout ratio in the Stock Dividend Data section on its ticker page, as shown below.

If you notice, the number listed here ($7.03) is different than the $6.52 mentioned above. That’s because we use a forward-looking earnings-per-share estimate to calculate various metrics on Dividend.com. This includes our DARS scoring model. The reason for using this forward-looking metric is that it is helpful in predicting future dividend increases and the potential to grow its payout. Analysts expect Johnson & Johnson to earn more this year than the last. And since this annualized payout is driven by earnings, we can assume that JNJ will increase its dividend this year.

The importance of using an annualized EPS estimate is that from quarter to quarter, plenty of things happen to a company. There might be temporary setbacks that could cause its EPS to dip. By looking at the entire year, we get a more accurate picture of what the firm is earning and what its annualized payout could look like.

Why Is the Annualized Payout Important?

So, why should you care about the annualized payout of stock? Well, for starters, it gives you a rough idea of the payments you’ll receive over the course of the entire year. Most firms in the United States will try and keep their dividends the same for four quarters before raising them. By buying JNJ today, it’s reasonable to assume that you’ll get that $3.20 per share over the next year. Again, management can do what they please, but, generally, they want to keep their shareholders happy and that means keeping the dividends flowing at the same rate. And when you compare the trends in earnings with annualized payouts, you can safely assume that they will do just that.

Annualized payouts come into play in a few other key metrics as well. Both dividend yield and dividend payout ratios use annualized payout data in their calculations. Both rates need that annualized amount to be accurate. Taking just one quarter’s worth of payouts would give you a much lower yield and payout ratio for JNJ, and it could lead to the wrong analysis of the stock or, even worse, losses if you aren’t careful.

Not Perfect

The thing to remember is that the annualized payout is just an estimate of what should or could come true. If a company cuts its dividend, then the annualized payout will be lower. If a company raises its dividend, then the annualized payout may be higher. And as we’ve shown, those dividends are mostly tied to earnings.

However, the probability of this estimate coming true is dependent on a very consistent pattern. If a firm raises its dividend every year in March, you can plan and adjust for that. However, if it switches things up each year, that has a dramatic effect on its annualized payout. Same can be said for those stocks that hand out a specific percentage of profits as dividends, as they do in Europe. Variability in EPS will directly impact that annualized rate all the time. This, in turn, will change other metrics like forward dividend yield and payout ratios.

And as we’ve mentioned above, management continues to be the biggest driver here. A major merger/buyout opportunity could completely change that annualized figure if management cuts the dividend for the needed cash.

But, as an estimate, it’s one of the best tools a dividend investor has.

The Bottom Line

Of the major metrics dividend investors need to watch, annualized payout could be one of the most important. It provides a standard of measurement to help compare multiple stocks with one another and, ultimately, drive better outcomes. It’s useful as a prediction tool and also to help us figure out trends in dividend growth. It’s not perfect, but it is a very useful tool indeed.