Real estate investment trust (REIT) valuation has been a complex subject for retail investors since it doesn’t follow the usual price/earnings multiple based valuation or the price to book/sales based valuation methods.

Real estate investment trusts are tax-advantaged companies that are (for the most part) exempt from corporate income tax. They are actively managed and own income-producing real estate, and they seek to profit by growing their cash flows. They often specialize in a particular type of property like shopping center REITs, healthcare REITs or industrial REITs, while still diversifying by geography or other factors.

Price/FFO per Share

The most popular REIT valuation method is P/FFO. P/FFO (or Current market Price/Funds From Operations) per share is very common amongst retail and institutional investors alike.

The formula to calculate Funds From Operations is as follows:

NET INCOME

+ Depreciation and amortization

- Gain on sale of assets

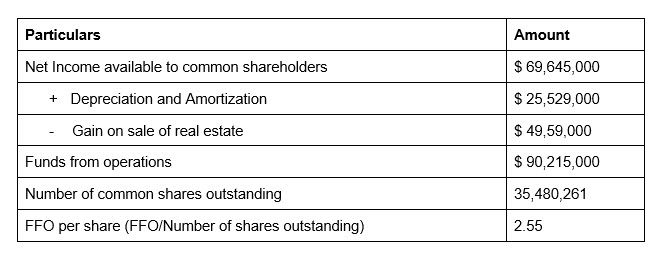

Let’s take actual numbers from LTC properties (LTC ), which is a healthcare REIT. Its annual income statement reveals the following numbers:

*All figures are as of 12-31-2014

On 12/31/2014 LTC had a market price of $43.15. This brings us to its P/FFO per share of 16.92.

Breaking Down the Formula

Real estate, by nature, has a property of appreciating in value rather than depreciating, which is the reason why we need to value it differently—since the EPS, which is used in the traditional price/earnings based stock valuation, accounts for the removal of depreciation. Gain on sale of real estate is subtracted because it isn’t income from continuing operations.

Similar to the PE analysis for any stock, this is P/FFO per share for a REIT, which is then applied in the same fashion you would use to value a stock: You compare it to its industry average and its most direct peers. Undervaluation or overvaluation would depend upon market conditions and future growth prospects for the industry and the company.

*P/FFO or P/AFFO are not easily available because they are non-U.S. GAAP measures and if the company hasn’t voluntarily calculated them for you, you would have to calculate it yourself. Hence the focus on calculation.

Other Key Valuation Techniques

Valuing REITs takes into account a few more things that you might not consider for stocks.

- Dividends – REITs are required by law to distribute at least 90% of their earnings to unit holders. This may result in a slight premium that would otherwise not be seen for stocks as investors are guaranteed a payout if the REIT is making money.

- Low volatility – Defensive REITs may sometimes display very low volatility, which may result in a higher valuation.

- Concentration risk – If a REIT has a majority of properties in a particular state or area then it’s referred to as concentration risk.

- Tenant concentration – Risk increases with higher concentration. A REIT analyst should pay special attention to a specific tenant that makes up a higher percentage of space rented or paid.

- Type of lease – A triple net lease is a lease where the lessee is required to pay maintenance charges, taxes and insurance to the vendor rather than the landlord, which results in premium valuation for the stock.

- Lease maturities – Short remaining lease terms provide an opportunity to raise rent in an expansionary economy while long remaining lease terms are good in a declining economy.

- Interest rates – High-interest rates generally have a positive effect on REITs. They make housing or office space more expensive to buy due to higher mortgage rates This sends more people renting space. Looking at the last period of rising rates, we can see the outperformance even better. Between June of 2003 and June of 2006, interest rates rose from 1% to 5.25%. During that time, the Dow Jones U.S. Select REIT Index managed to return 27.68% annually and provided a whopping total return of over 108%.

The Bottom Line

REITs due to their structure have high payouts, and high dividend yields are very popular amongst income investors. A good deal of research is required before investing in REITs, as they don’t receive as much coverage as stocks making it hard to find key valuation metrics.

For a complete list of Real Estate Investment Trusts, click here. Also, check out our definitive guide to Real Estate Investment Trusts.