Investors seeking a solid performer in the Technology sector with a commendable dividend history can look towards a prominent Tech Services mega-cap stock, now reaffirmed as a holding in the esteemed Best Sector Dividend Stocks model portfolio. This stock stands out with a 39% forward payout ratio, aligning well with the industry average, and showcasing its financial stability. Its impressive 19-year track record of dividend increases places it in the top echelon of dividend stocks, with expectations of continued growth.

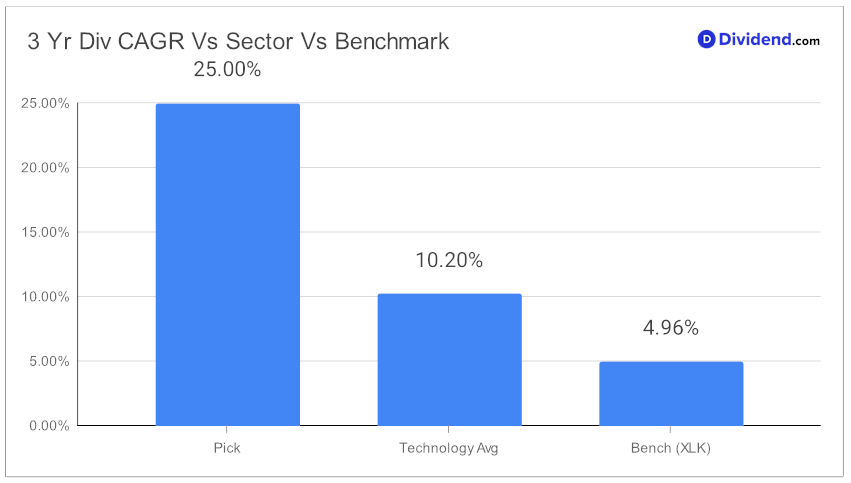

What makes this stock particularly appealing to balanced dividend investors is its robust 3-year dividend compound annual growth rate (CAGR) of 25%, ranking it in the top 20% of all dividend stocks.

Additionally, its performance this year has been remarkable, yielding a 24% return, outpacing both the S&P 500 and the Tech Services industry averages.

Looking ahead, investors can anticipate the next payout, estimated at $1.290 per share, around December 15. This upcoming distribution further cements the stock’s status as a reliable income generator.

For those interested in a deeper dive into this investment opportunity, an in-depth analysis follows, offering insights into its yield, dividend safety, potential returns, and risk profile, tailored exclusively for Technology dividend stocks. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on October 3, 2023.

This blend of attributes makes it a compelling choice for investors seeking both stability and growth in their portfolios.