In the constantly evolving sector of Technology, balanced dividend investors have their work cut out for them, searching for that ideal blend of safety, yield, and potential for returns. Finding a large-cap Tech Services stock that not only promises stability but also proves itself with performance metrics is a triumph. The latest gem added to the Best Sector Dividend Stocks model portfolio stands out for several compelling reasons.

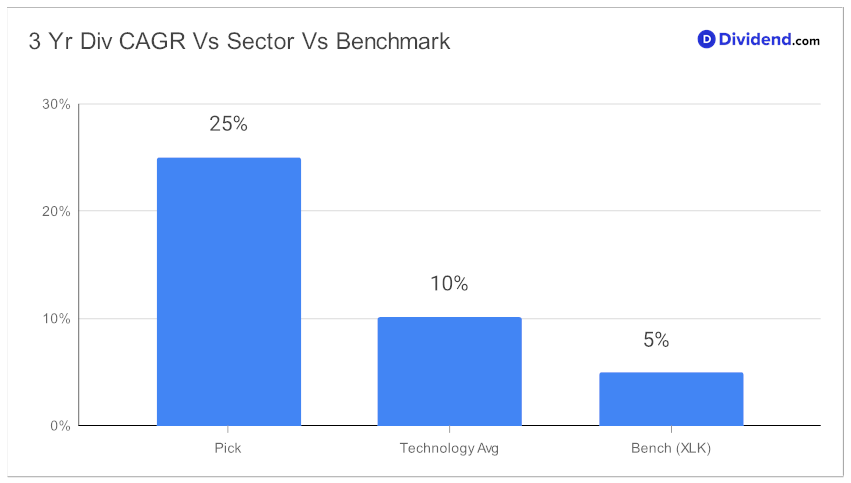

This powerhouse boasts a prudent forward payout ratio of 39%, aligning closely with the industry’s average, ensuring that its dividends are well-covered while still providing room for operational flexibility. Impressively, the company’s commitment to shareholder returns is evident through its 19-year track record of consistent dividend increases, a feat placing it in the upper echelon of dividend stocks. This reliability, paired with an extraordinary 25% 3-year dividend compound annual growth rate, positions it as a noteworthy contender for investors seeking both growth and income.

Year-to-date, the stock has mirrored the S&P 500’s strength, delivering an 11% return, and outperforming the broader Tech Services industry. What’s particularly attention-grabbing is the forthcoming dividend payout. Investors who jumped on board before October 11 are looking forward to a significant 15% hike in their gains, anticipating a generous $1.290 per share come November 15.

Curious about the detailed insights that led to the selection of this high-performing stock? The in-depth analysis that follows unpacks the meticulous recommendation process, optimized within the Technology sector, balancing yield, dividend safety, return potential, and risk. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on October 3, 2023.

This careful curation ensures not only a robust dividend strategy but a future-facing portfolio poised for resilience and growth.