Are you searching for a strong, reliable asset to add to your dividend portfolio? One that combines impressive dividend growth, a proven track record, and an appealing yield, with the added benefit of low correlation to broader equity market volatility? In the expansive tech sector, we’ve discovered an outstanding candidate.

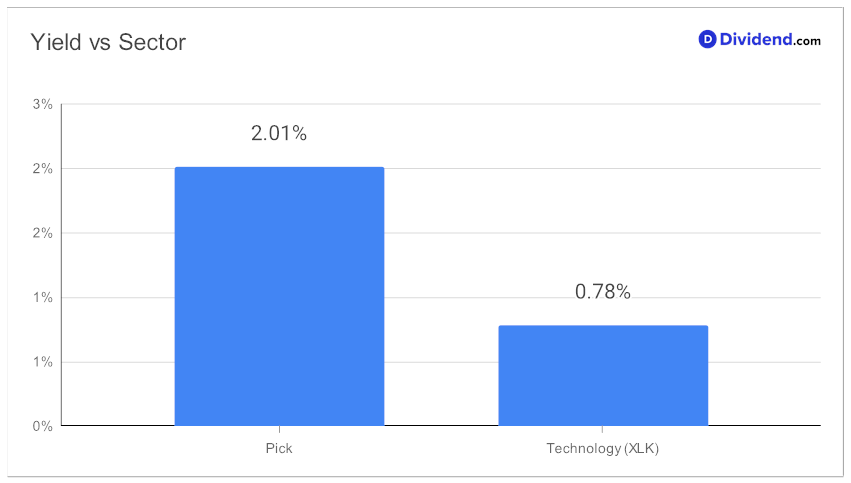

This large-cap tech services juggernaut is a titan of stability with a 48-year history of consistent dividend increases, ranking it within the top 10% of all dividend stocks. With a solid 3-year dividend CAGR of 11%, it sits comfortably within the top 40% of all dividend stocks. And despite yielding 2.01%, the stock does a better job than the entire technology sector.

A beta of 0.82 promises lower risk and enhances portfolio diversification.

Furthermore, you can look forward to an anticipated next payout of an estimated $1.250 per share, expected to be declared on or around August 3.

While forming our recommendation, we’ve also factored in key growth drivers and financial performance discussed by the company’s management during its Q4 earnings call held on July 26, 2023.

Immerse yourself in our in-depth stock analysis to understand why this should be your next tech dividend stock.