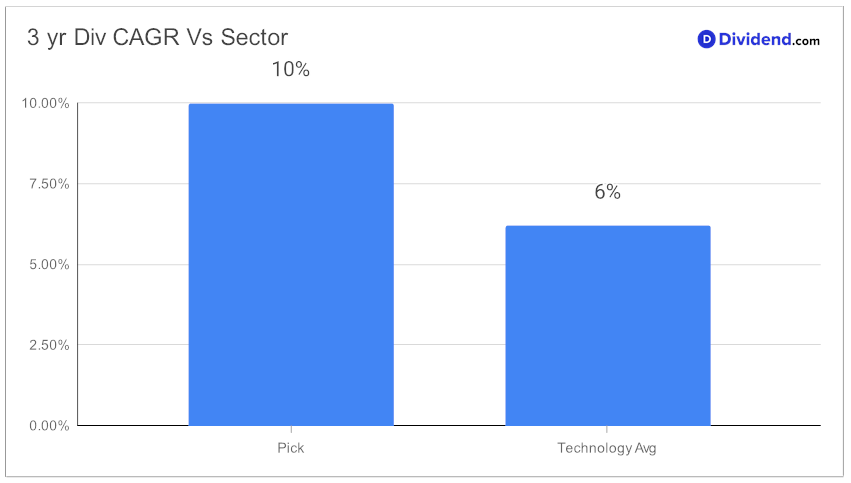

In the ever-evolving landscape of the technology sector, a mid-cap Tech Hardware stock has recently made waves among savvy investors looking for balanced dividend opportunities. Notably characterized by a forward payout ratio of 42%, it aligns closely with the sector’s average, showcasing financial prudence while maintaining a competitive edge. What’s more intriguing is its 10% three-year dividend compound annual growth rate, positioning it within the top echelon of dividend-yielding stocks, a testament to its commitment to shareholder returns.

As the next dividend payout approaches, estimated at $0.300 per share around May 3, investors are keenly watching.

While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q1 2024 earnings call held on February 2, 2024. The technology company, recognized for its advancements in audio and visual innovations, reported meeting its quarterly revenue expectations and surpassing earnings forecasts.

Despite facing challenges from the macroeconomic climate and consumer electronics spending, the company projects a mid-single-digit decline in foundational licensing revenue for the fiscal year. However, the company is optimistic about its future growth, particularly with its proprietary audio and visual technologies, expecting high single-digit growth for the year and a significant compound annual growth rate over the next three to five years. This outlook underscores a strategic focus on leveraging market ecosystems and expanding into new growth areas to drive mid-term growth and achieve long-term financial objectives.

The stock’s inclusion in a model portfolio dedicated to the best sector dividend stocks is not merely about the immediate gains but a strategic move. The selection criteria, focused on a harmonious blend of yield, dividend safety, return potential, and risk, specifically within the Technology sector, highlights the meticulous approach towards investment that appeals to balanced dividend investors.