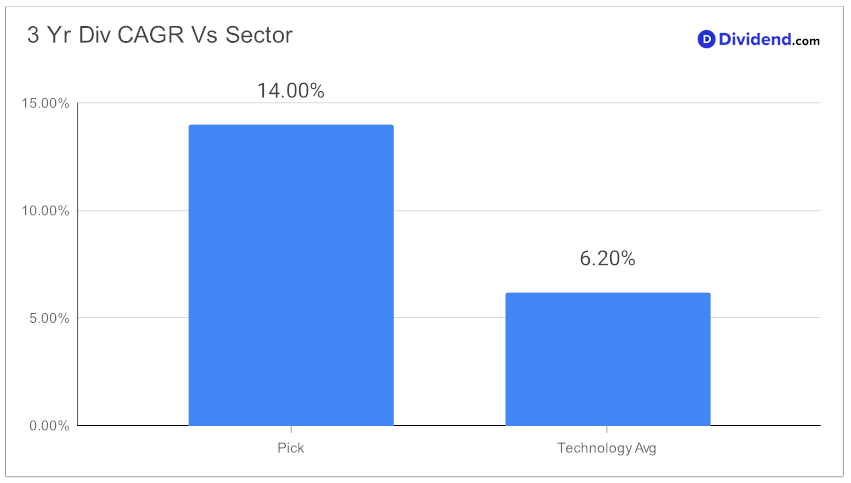

In the landscape of technology dividend stocks, a standout large-cap Tech Services player has once again solidified its position within a prestigious model portfolio, designed for those who seek a balanced approach to dividend investing. This company, with its impressive 40+ year track record of dividend increases—a feat placing it in the top 10% of dividend stocks—continues to signal robust financial health and commitment to shareholder value. Its 14% three-year dividend compound annual growth rate not only highlights its growth potential but also ranks it in the top 40% of all dividend stocks.

Investors looking for a less volatile option will find solace in the company’s 0.79 beta, indicating its monthly returns are less correlated with the broader equity markets, providing an attractive diversification benefit. Year-to-date, the stock has outperformed, delivering a 5% return against the backdrop of its industry and the broader S&P 500.

As we dive deeper, the next payout awaits—an unchanged, qualified $1.400 per share dividend, underscoring the company’s consistent and reliable income stream for shareholders.

While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q2 2024 earnings call held on February 1, 2024. The human capital management solutions provider reported a solid financial performance, with a 6% increase in revenue and a 9% rise in adjusted EPS for the second quarter. The company achieved a record in new business bookings, driven by growth in small business and international markets, despite a slight decline in retention rates. The labor market’s resilience was also noted, with stable hiring trends.

Management adjusted the fiscal 2024 outlook slightly due to changing interest rates and investments in technology, maintaining an optimistic revenue growth projection and expecting continued EPS growth. This reflects strategic agility in navigating economic shifts and investing in future growth.

This analysis beckons investors to explore further, delving into the intricate blend of yield, dividend safety, return potential, and risk management that earmarks this stock as a key holding for those invested in the technology sector’s dividends.