In the realm of Technology dividend stocks, a well-covered mid-cap electronic manufacturing services (EMS) & Distribution stock stands out as a new entrant in the Best Sector Dividend Stocks model portfolio. This inclusion is particularly notable for balanced dividend investors seeking a blend of yield, dividend safety, return potential, and risk management. The stock underlines its appeal with a forward payout ratio of 21%, aligning closely with the sector’s average of 15%. This ratio not only signals a sustainable dividend policy but also leaves room for growth and reinvestment in the business.

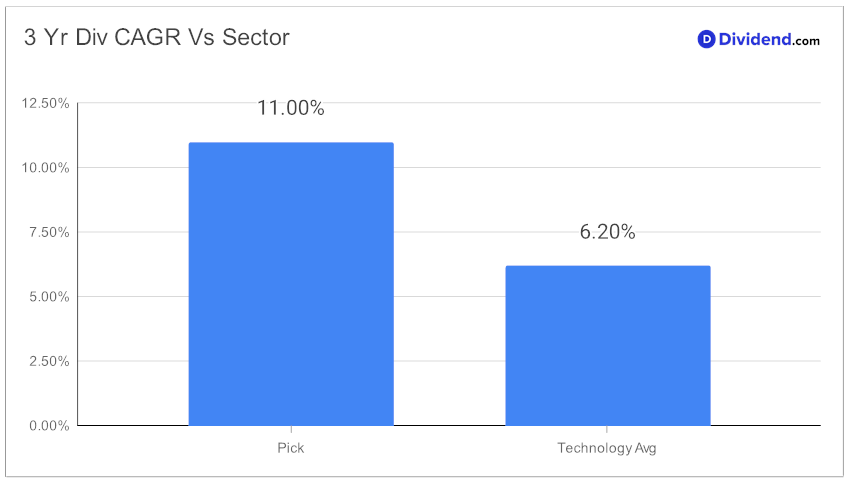

Impressively, the stock boasts a three-year dividend compound annual growth rate (CAGR) of 11%, positioning it in the top 40% of all dividend stocks. This growth trajectory is a testament to its financial stability and commitment to rewarding shareholders. Looking ahead, investors can anticipate the next payout, estimated at $0.310 per share, around February 15th. This upcoming dividend payment further solidifies its reputation as a reliable income source.

For investors intrigued by this addition, an in-depth stock analysis follows, providing a comprehensive review of its financial health, market position, and future prospects. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q1 2024 earnings call held on November 2, 2023.

This analysis aims to offer a detailed perspective, helping investors make informed decisions in their pursuit of balanced, dividend-focused investments.