In the realm of Technology dividend stocks, one mega-cap Tech Hardware contender stands out for its robust returns and steadfast commitment to shareholder rewards.

With a 40% forward payout ratio that aligns closely with its sector average, this stock demonstrates both prudence and potential. Its 12-year streak of dividend increases places it in the lofty top 10% of dividend champions, signaling a reliable and growing income stream for balanced dividend investors.

As you seek an optimized balance of yield, safety, potential returns, and risk specifically within the Technology sector, consider this: the next payout is not just an expectation but a reflection of a consistent and well-covered commitment. The stock’s strategy of blending yield and growth is a testament to its long-term appeal, especially for those prioritizing income and stability in their portfolios.

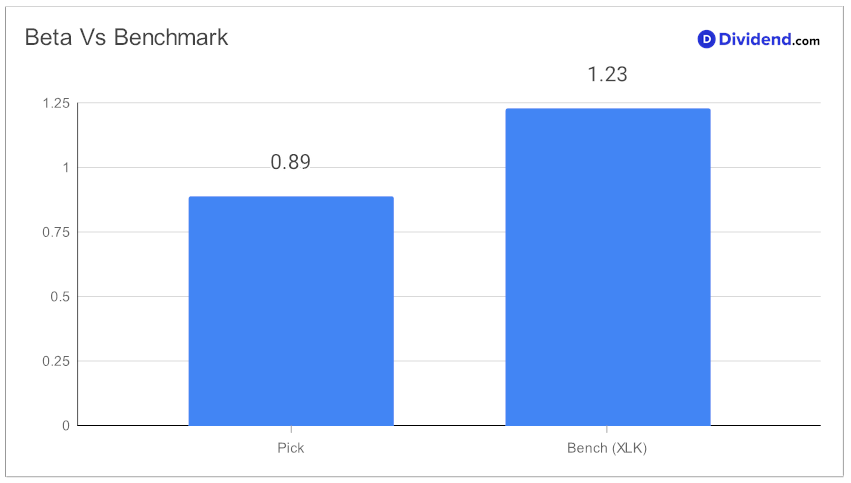

Additionally, the stock also has a beta of 0.89, indicating similar volatility compared to the broader market and lower than the technology sector.

While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q1 2024 earnings call held on November 15, 2023. Dive deeper into our in-depth analysis to understand how this standout stock could serve as a cornerstone in your investment strategy, marrying consistent dividends with the dynamic world of tech investments.