If you’re a balanced dividend investor seeking a solid play in the Technology sector, look no further. We’re talking about a well-covered mega-cap Tech Hardware stock that has consistently proven itself as a worthy candidate for income and growth.

Firstly, let’s talk dividends. With a forward payout ratio of 37%, this stock not only ensures a sustainable dividend but also sits comfortably within the sector average of 45%. What’s more impressive? A 13-year streak of dividend increases that places it in the top 10% of all dividend-paying stocks. Future dividend hikes are also expected, ensuring an income stream that grows over time. In fact, the next dividend payout is an unchanged, qualified $0.390 per share, having gone ex-dividend on October 3rd, and will be paid out on October 25th.

When it comes to performance, the stock has shown resilience. Year-to-date returns stand at 13%, which, although slightly lagging behind the S&P 500’s 14%, is noteworthy in its own right. However, it’s crucial to factor in the broader Tech Hardware industry’s explosive 35% returns for contextual understanding.

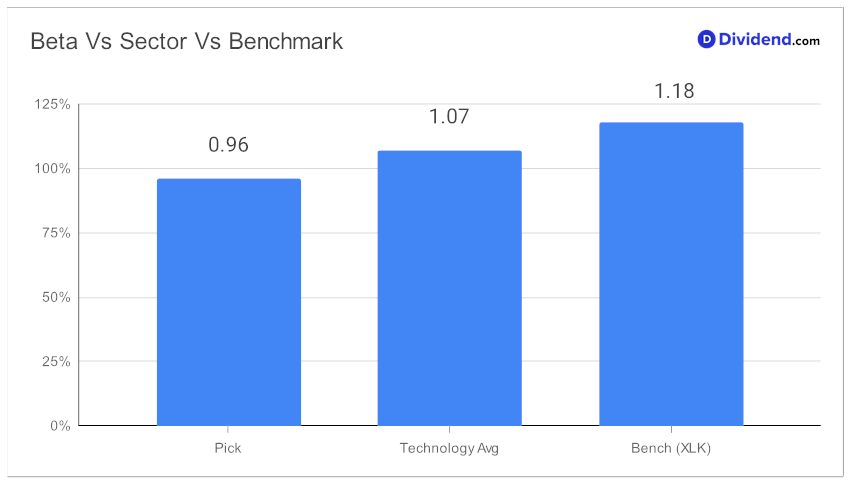

At the same time, the stock trades at a beta of just less than 1, bringing its volatility in line with the broader markets and slightly better than the technology sector.

By optimizing for an equal blend of yield, dividend safety, returns potential, and risk, we’ve reaffirmed this stock as a holding in our Best Sector Dividend Stocks model portfolio. We have also taken into account the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on August 17, 2023.

Stay tuned for our in-depth analysis that delves into the details, and discover why this stock could be the linchpin in your balanced dividend strategy.