If you’re a balanced dividend investor with an eye on the Technology sector, you’ll be intrigued by the latest addition to our Best Sector Dividend Stocks model portfolio. This well-covered large-cap stock in the semiconductor industry not only aligns with the sector average but also stands out for its impressive attributes.

One of the most compelling aspects is its forward payout ratio of 31%, which is remarkably low, making it a stable and reliable income source. This figure is also in line with the semiconductor industry average of 25%, emphasizing the company’s financial health.

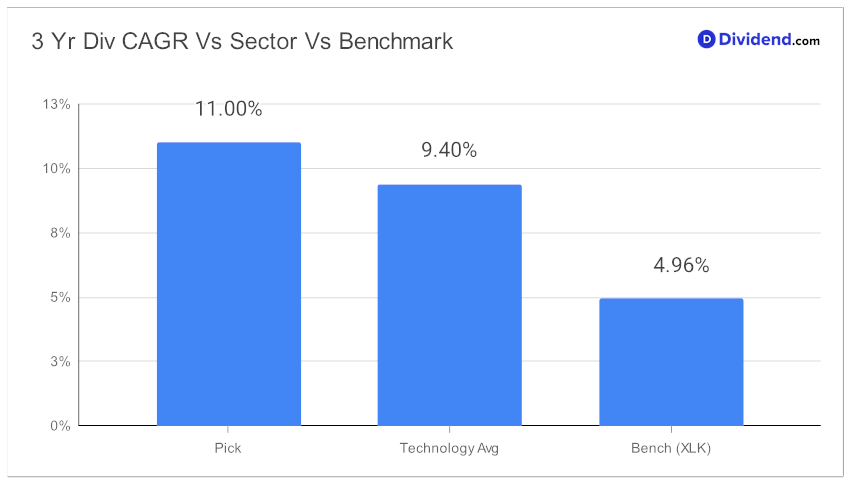

Not to be overlooked is its 9-year dividend increase track record, placing it in the top 30% of all dividend-paying stocks. This bodes well for future dividend hikes, especially when coupled with an 11% three-year dividend per share compound annual growth rate, a statistic that ranks in the top 40% of dividend stocks.

However, year-to-date returns have been modest at 6%, compared to the 14% for the S&P 500 and a whopping 96% for the semiconductor industry. This could be partially attributed to the company coming under the pressure of slowing growth seen across smartphone manufacturers, leading to lower utilization rates and inventory build-ups. The company is expected to counter this by leveraging its expertise in semiconductor design and manufacturing prowess & broadening its product portfolio in the coming days.

Despite this, the company’s next estimated payout of $0.680 per share around November 3rd offers a glimmer of immediate income potential.

We also take into account the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on August 8, 2023.

For those hungry for details, the in-depth stock analysis that follows dives into how this new addition optimizes for an equal blend of yield, dividend safety, returns potential, and risk, specifically within the Technology sector.