In the ever-evolving landscape of dividend investing, one particular Tech Services stock has recently garnered attention for its consistent performance and reliable returns. Distinguished by nearly a 20-year history of dividend increases—a feat placing it in the upper echelon of dividend stocks—this mega-cap entity demonstrates a remarkable blend of stability and growth potential.

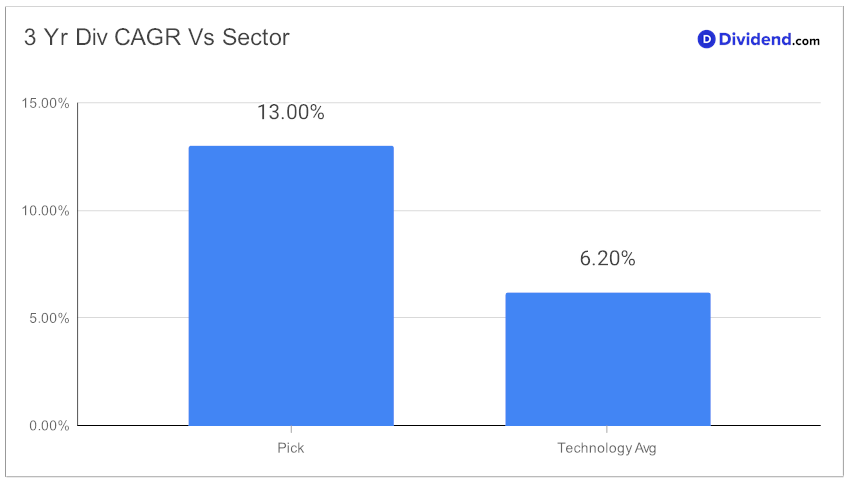

Notably, its three-year dividend per share compound annual growth rate (CAGR) of 13% ranks it favorably among its peers, showcasing a strong track record in shareholder returns. This performance is further highlighted by its year-to-date return of 7%, outpacing the broader Tech Services industry, though trailing behind the S&P 500.

The upcoming dividend payout remains steadfast at $1.290 per share, with the ex-dividend date set on January 17 and a payment date scheduled for February 15. This consistent payout reflects the company’s commitment to shareholder value and underlines its potential as a balanced investment in a dividend-focused portfolio.

For investors seeking a nuanced blend of yield, dividend safety, and growth potential within the Technology sector, this stock presents a compelling option. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q1 2024 earnings call held on December 23, 2023.

Our in-depth analysis delves further into its financial health, strategic position, and risk profile, offering a comprehensive view for discerning investors.