Investors seeking a harmonious blend of stability and growth in the Technology sector will find compelling reasons to consider a prominent Tech Services stock in their portfolio. This large-cap entity stands out with a 35% forward payout ratio, aligning closely with the sector’s average. What sets it apart is its remarkable 12-year track record of dividend increases, placing it in the upper echelon of dividend stocks. Looking ahead, future hikes seem likely, reinforcing its attractive profile.

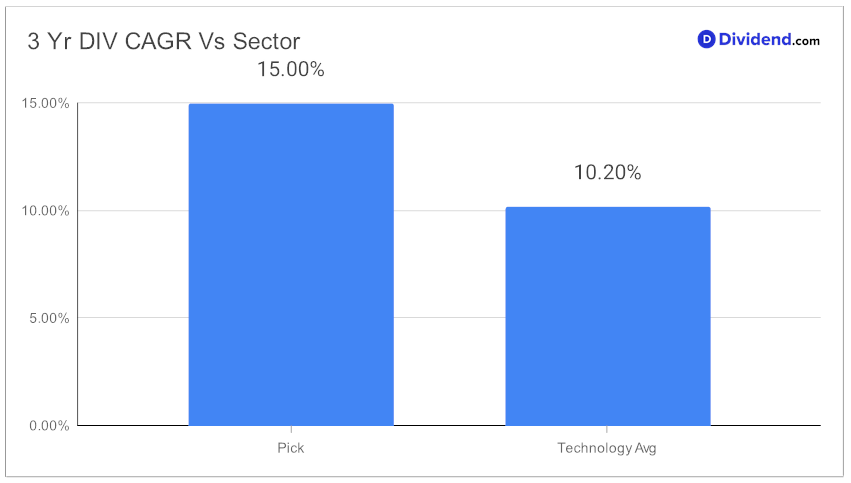

The stock’s 15% 3-year dividend compound annual growth rate (CAGR) further solidifies its position in the top 40% of dividend-yielding stocks. Moreover, its low beta of 0.61 signals reduced market correlation, offering a diversification advantage for equity portfolios.

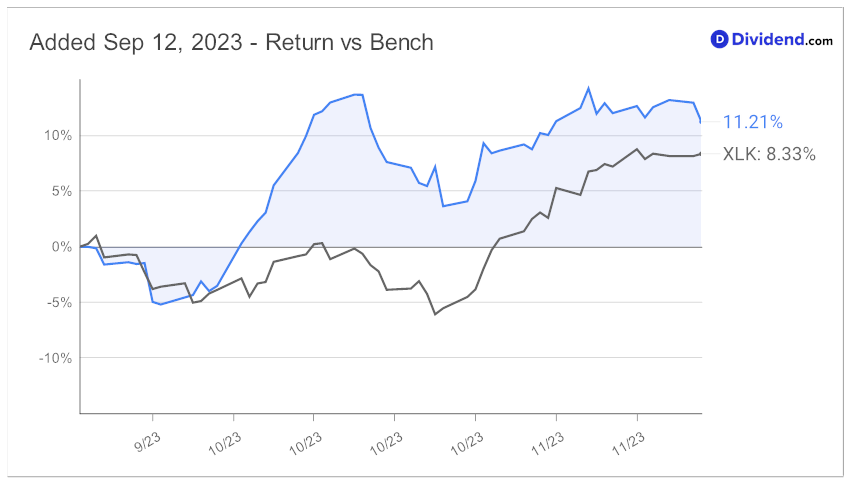

Year-to-date, it has outperformed, delivering a 23% return compared to the S&P 500 and its industry peers. Additionally, since making it to this portfolio back in September, the stock has managed to comfortably beat this portfolio’s benchmark.

For balanced dividend investors, the next payout is particularly noteworthy: a steady $0.470 per share, following its November 14 ex-dividend date, with a forthcoming pay date on December 4. This consistency exemplifies the stock’s robust dividend profile.

Dive into our detailed analysis to uncover more insights about this tech stock’s dividend safety, yield potential, and overall risk-return balance. Here, we merge thorough research with a keen focus on yield, safety, and performance potential, exclusively within the Technology dividend stock domain. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q2 2024 earnings call held on October 28, 2023.