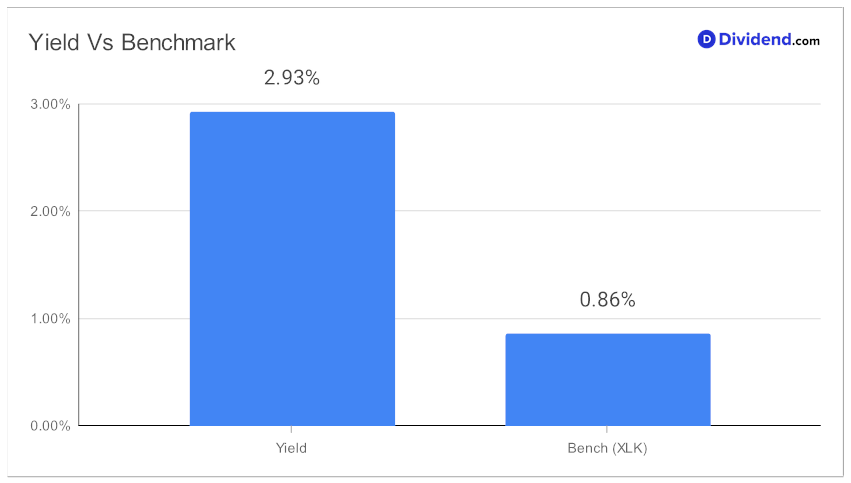

In the realm of dividend investing, there’s a tech hardware titan that’s making waves with its remarkable performance and steadfast reliability. This mega-cap stock stands out in its sector, not just for its size, but for its impressive track record in rewarding investors. A testament to its financial stability, the stock boasts a forward payout ratio of 37%, aligning seamlessly with the industry average. What truly sets it apart is its 12-year streak of dividend increases, a feat placing it in the top echelon of dividend stocks. Additionally, the stock currently yields 2.93%, significantly higher than its technology sector competitors.

Investors seeking a balance of yield, safety, potential returns, and risk in technology dividends will find this stock a compelling choice. It has demonstrated resilience, returning 12% year-to-date, outshining the broader market but still trailing behind its industry peers. The anticipation builds as the next estimated payout of $0.390 per share is expected around December 7th.

This teaser paves the way for an in-depth analysis, offering a deeper dive into the stock’s performance metrics, future growth prospects, and how it fits into a balanced dividend investment strategy. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q1 2024 earnings call held on November 15, 2023.

Stay tuned for a comprehensive review that promises to enrich your investment decisions.