In the landscape of technology dividend stocks, a standout performer has consistently delivered value to balanced dividend investors. With a forward payout ratio of 35%, it mirrors the tech services sector average, showcasing financial prudence while ensuring shareholder returns. This large-cap Tech Services stock not only boasts a commendable 13-year streak of dividend increases—placing it in the top echelon of dividend growth stocks—but also anticipates future enhancements to its dividends.

Its dividend growth, marked by an 11% 3-year CAGR, ranks it favorably among peers, while a beta of 0.54 signals lower correlation with broader market movements, offering a diversification benefit to equity portfolios.

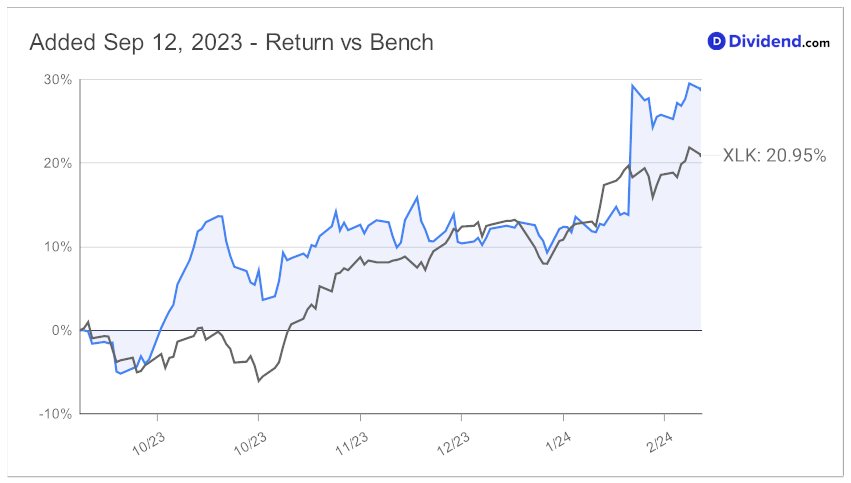

Year-to-date, this entity has outperformed, returning 14% against the S&P 500’s 5% and its industry’s similar margin, underscoring its robustness in a volatile market environment. Additionally, since making it to this portfolio back in September 2023, the stock has comfortably beaten the portfolio benchmark.

The next payout, an 8.5% increase to $0.51 per share, went ex-dividend on February 9, with a March 1 pay date, highlighting the company’s commitment to rewarding investors.

This narrative forms the prelude to an in-depth analysis, guiding investors through the intricacies of optimizing yield, dividend safety, return potential, and risk within the technology sector’s dividend landscape. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2024 earnings call held on January 26, 2024.