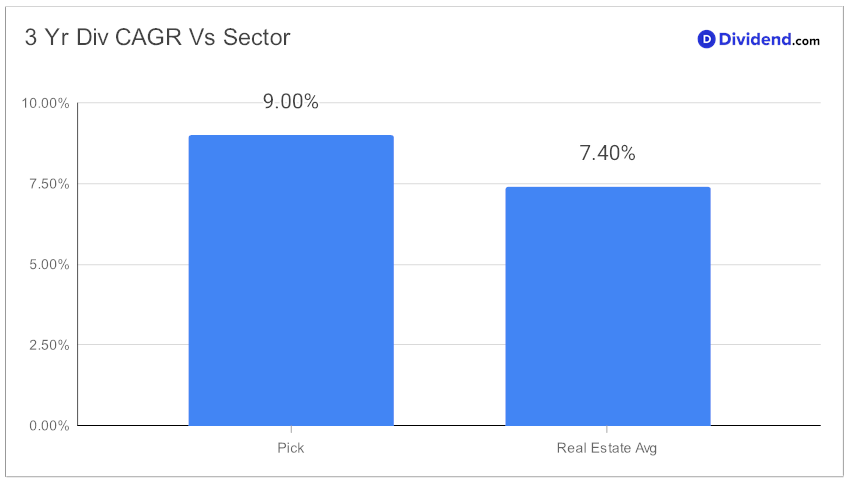

Looking for a robust addition to your dividend portfolio? Consider our latest inclusion in the Best Sector Dividend Stocks model portfolio, a well-covered large-cap eREIT known for its financial stability and attractive returns. This entity stands out with a 12-year streak of increasing dividends, ranking in the top 10% of dividend stocks. Its consistent performance is set to continue, promising future increases. The 3-year Dividend per Share Compound Annual Growth Rate (CAGR) of 9% places it firmly in the top 40% of all dividend stocks, indicating reliable growth.

With a beta of 0.68, this stock offers a unique advantage – its monthly returns are less correlated to broader equity markets, enhancing portfolio diversification. In terms of immediate benefits, investors can look forward to a 4.9% increased non-qualified dividend of $1.700 per share. The stock went ex-dividend on December 27th, with the payout arriving promptly on February 1st.

The selection for our model portfolio was meticulous, optimizing for a balance between yield, dividend safety, returns potential, and risk, specifically among Real Estate dividend stocks. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on October 26, 2023.

This inclusion isn’t just about the next payout or impressive growth stats; it’s about strategic portfolio enhancement. Dive into our in-depth analysis to understand how this holding can elevate your investment strategy.