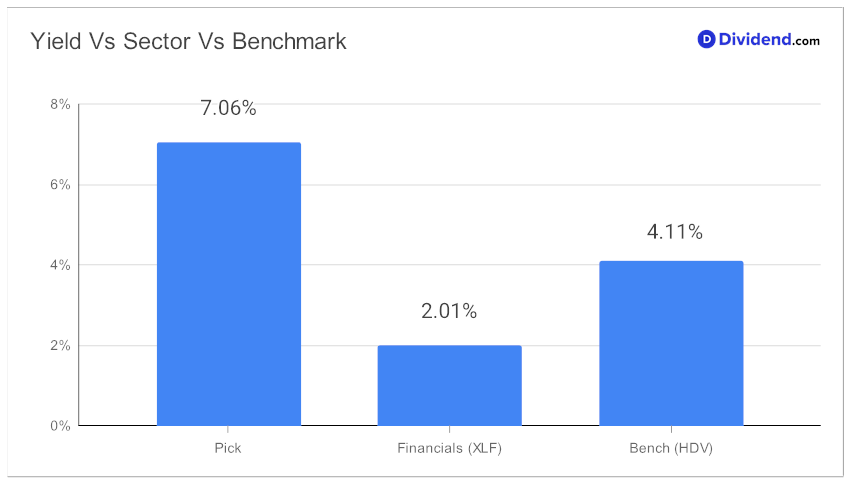

If you’re a monthly dividend investor, one stock has consistently checked all the boxes for yield attractiveness and dividend safety, not to mention a dash of returns potential. This mid-cap Business Development Company (BDC) offers an enviable 7.06% forward dividend yield, placing it among the top 20% of all dividend stocks. Though the BDC industry average is 10.8%, caution is advised as high yield could sometimes be a dividend trap.

One of the most appealing features of this stock is its 12-year record of increasing dividends, situating it in the top 10% of all dividend stocks. And there’s more good news—future increases are expected. This comes at a time when the next payout is set to see a 2.2% increase to $0.235 per share, having gone ex-dividend on October 5, with a pay date of October 13.

But what about performance? Year-to-date, the stock has returned 8%, lagging behind the S&P 500 at 14% and the BDC industry at 17%. While it may not be a market leader in terms of returns, its proven dividend track record and robust yield offer a cushion against market volatility.

While forming the recommendation, we’ve taken into account the growth drivers and financial results discussed by the company management during their Q2 2023 earnings call held on August 4, 2023.

Stick around for an in-depth stock analysis that follows, where we’ll delve into optimizing for yield attractiveness and dividend safety, along with a tempered view on returns potential and risk, focusing solely on monthly payers.