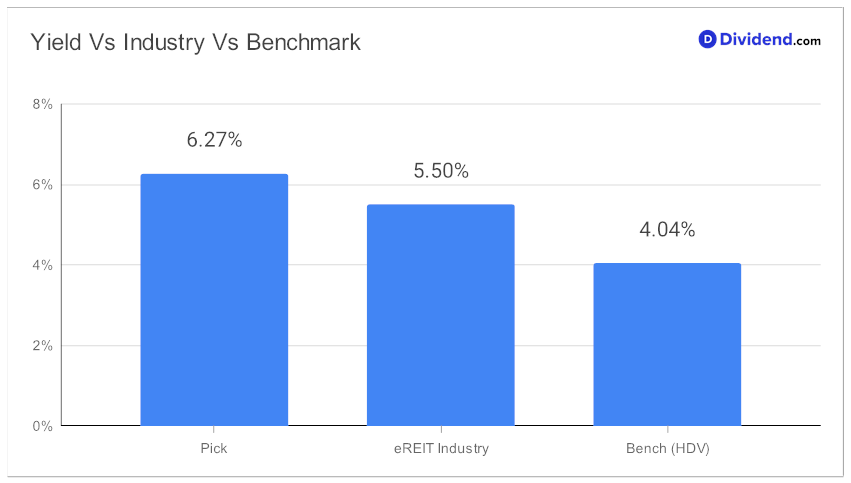

Investors seeking consistent monthly returns will find this well-covered mid-cap equity Real Estate Investment Trust (eREIT) reaffirming its place in the Best Monthly Dividend Stocks model portfolio. Ranking in the top 20% of dividend stocks with a forward yield of 6.27%, it surpasses the eREIT industry average of 5.5%.

Care must be taken to avoid dividend traps, but with a robust 3-year dividend per share compound annual growth rate (CAGR) of 64%, this holding demonstrates both yield attractiveness and dividend safety.

Notably, an unchanged non-qualified $0.080 per share that went ex-dividend on July 28 is scheduled for an August 15 pay date.

While forming our recommendation, we’ve also factored in key growth drivers and financial performance discussed by the company’s management during its Q2 earnings call held on August 5, 2023.

Optimizing for these traits, along with lesser considerations for returns potential and risk among monthly payers, this offering invites an in-depth analysis to uncover further investment opportunities.