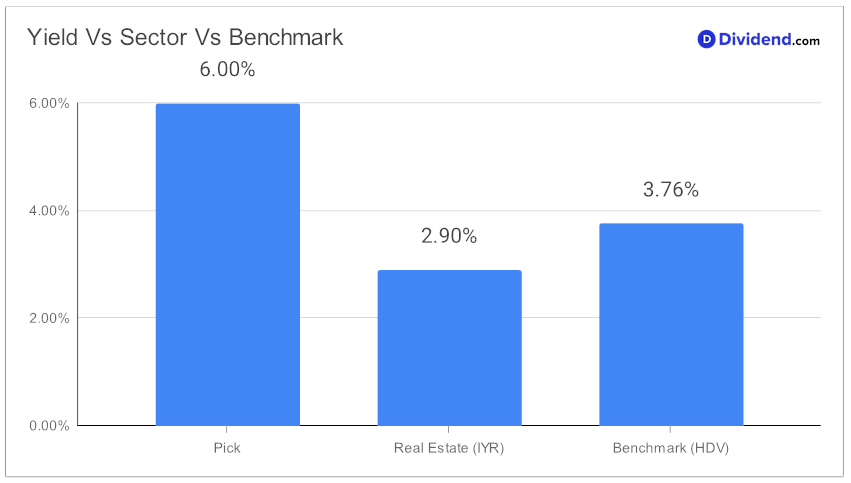

In the realm of monthly dividend investing, discerning investors continuously seek robust opportunities that not only promise attractive yields but also ensure stability and growth potential. Amidst this landscape, a well-covered mid-cap equity REIT stands out, not just for its impressive forward dividend yield of 6%—surpassing the eREIT industry average of 5.7%—but also for its remarkable three-year dividend compound annual growth rate (CAGR) of 188%, positioning it in the top 20% of all dividend stocks. Such figures not only highlight the investment’s yield attractiveness but also its dividend safety, crucial factors for those prioritizing monthly income.

Today marks a pivotal moment for this entity as it went ex-dividend with an unchanged non-qualified payout of $0.080 per share. This event is a testament to the investment’s consistency and reliability, pivotal for monthly dividend investors.

While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on February 24, 2024. In 2023, the hotel-focused REIT reported solid operational performance and strategic growth amidst an uncertain economic climate. It managed to significantly increase its Revenue Per Available Room (RevPAR), mainly driven by Average Daily Rate (ADR) improvements. Despite fluctuations in operating profitability, the outlook for 2024 remains cautiously optimistic, with expectations of continued growth in net income and RevPAR, amidst moderate increases in operating costs.

The selection process, meticulously focusing on Yield Attractiveness and Dividend Safety, while considering Returns Potential and Risk, underscores the thoroughness of the recommendation.

For those intrigued by the promise of high yield and growth within the monthly dividend sphere, an in-depth analysis awaits, offering a deeper dive into the metrics that make this investment a noteworthy consideration for your portfolio.