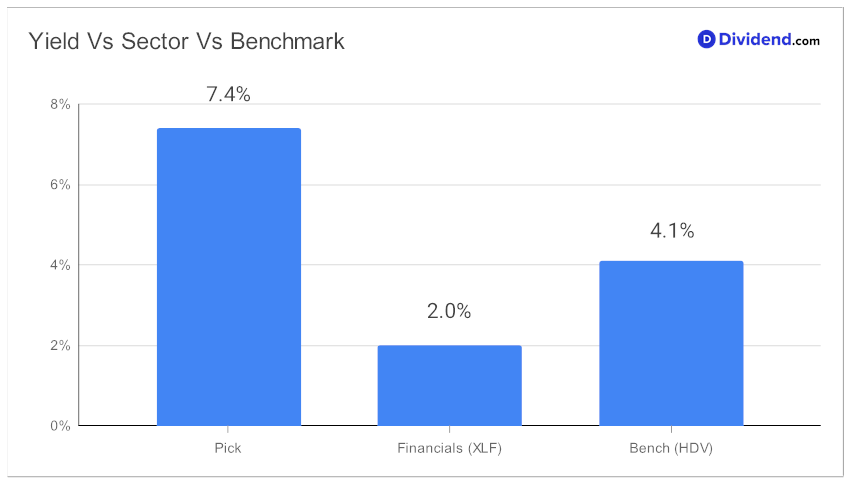

In the realm of monthly dividend investing, a standout performer has cemented its position in the sought-after Best Monthly Dividend Stocks model portfolio. Boasting a forward dividend yield of 7.40%, this gem not only outshines many with its generous payouts but also aligns with the discerning investor’s dual quest for yield attractiveness and dividend safety. While the industry average may hover around 11.8%, savvy investors recognize the potential pitfalls of chasing the highest yields, mindful of the deceptive allure of dividend traps.

Year-to-date, this mid-cap beacon has delivered a solid 3% return, showcasing its steadfast resilience in a turbulent market that has seen similar entities stride at a higher rate. Yet, it’s not just the past performance that keeps investors anchored; it’s the anticipation of the next payout. With an unchanged distribution of $0.235 per share going ex-dividend come next Tuesday, the commitment to consistency is clear.

Stay tuned as we delve deeper into the strategic analysis of this investment haven, where stability meets growth, all the while maintaining a coveted spot within the portfolios of those who prioritize a steady monthly income. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q2 2023 earnings call held on August 4, 2023.