In the dynamic world of monthly dividend investing, discerning investors are continually seeking robust opportunities. A notable mid-cap Business Development Company (BDC) has recently been reaffirmed as a key holding in the prestigious Best Monthly Dividend Stocks model portfolio, underlining its appeal for those prioritizing steady income streams.

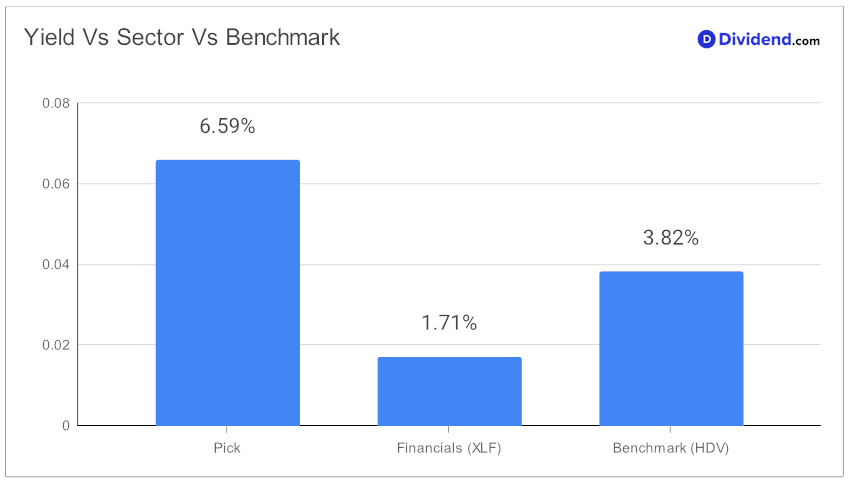

This BDC stands out with a forward dividend yield of 6.59%, positioning it in the upper echelon, the top 20% of high-yield dividend stocks. However, it’s crucial for investors to navigate the high-yield waters cautiously, as the BDC industry average hovers around 10.6%.

Year-to-date, this BDC has demonstrated resilience, delivering a 2% return, mirroring the industry average and outpacing the S&P 500’s stagnant growth. Investors should take note of the upcoming dividend payout, maintaining an unchanged rate of $0.240 per share, with the ex-dividend date slated for February 7. This steady payout is a cornerstone of its attractiveness.

Our in-depth analysis delves deeper, evaluating the BDC through a meticulous lens that optimizes for Yield Attractiveness and Dividend Safety, while also considering Returns Potential and Returns Risk. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 3, 2023.

This comprehensive approach ensures that only the most promising monthly payers are considered. Stay tuned for a detailed exploration of why this BDC is a distinguished player in the realm of monthly dividend investing.