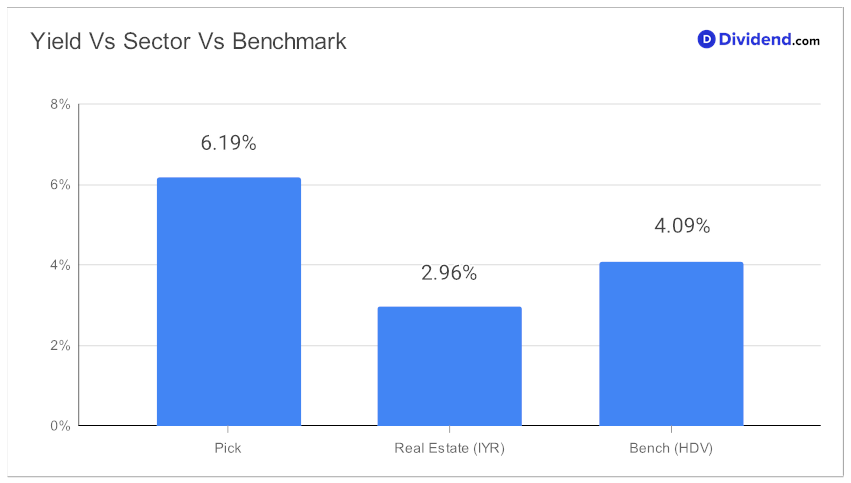

In the ever-changing world of investment, one asset class has remained a beacon for those seeking reliable, monthly income: high-yield eREITs. If you’re an investor focused on monthly dividends, the latest addition to our Best Monthly Dividend Stocks model portfolio is certainly worth your attention. This large-cap eREIT not only offers an enticing forward dividend yield of 6.19%, which places it in the top 20% of dividend stocks but also stands a cut above the industry average of 6.1%.

While high yield can sometimes be a red flag for a dividend trap, this particular holding bucks the trend. It boasts an enviable 30-year history of dividend increases, ranking it in the top 10% of dividend stocks, and signals future hikes are in the offing.

If diversification is your goal, you’d be pleased to know that its beta of 0.79 suggests lower correlation with equity markets, enhancing its value in an equity portfolio.

What’s more immediate, however, is the next payout. Investors should note that a non-qualified dividend of $0.256 per share, marking a 0.2% increase, is going ex-dividend tomorrow, September 29. This presents a timely opportunity to benefit from the holding’s robust dividend strategy.

It is important to note that persistant inflation and Fed’s interest hike cycles have made it difficult for commercial businesses to operate profitably – a space where our pick has a significant exposure. This is reflected in the pick’s YTD performance, which is down nearly 21% compared to S&P 500, which is up 14%.

However, given our pick’s solid balance sheet and known track record of managing a well-diversified portfolio of reliable rent payers across non-discretionary businesses including convenience stores, pharmacies and big-box store operators, it seems well positioned to thrive in the current economic environment.

We also take into account the growth drivers and financial results discussed by the company management during their Q2 2023 earnings call held on August 3, 2023.

For an in-depth analysis on this stock, stay tuned. Our recommendation process rigorously assesses Yield Attractiveness, Dividend Safety, and to a lesser extent, Returns Potential and Returns Risk, focusing exclusively on monthly payers to ensure you’re making the most informed decision.