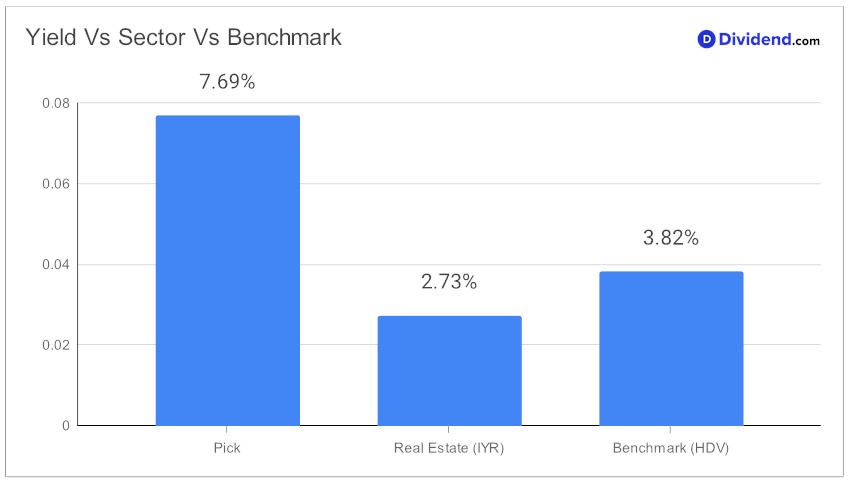

In the realm of monthly dividend investments, discerning investors constantly seek opportunities that blend attractive yields with financial stability. Amid this search, a standout mid-cap eREIT has reaffirmed its position in the esteemed Best Monthly Dividend Stocks model portfolio, signaling its robustness in a competitive field. Boasting a forward dividend yield of 7.69%, this entity not only surpasses the industry average of 5.7% but also positions itself within the top echelon of high-yield investments. However, investors are advised to exercise caution, as high yields can sometimes signal dividend traps.

Further solidifying its appeal, the company has demonstrated an impressive 30% 3-year dividend per share compound annual growth rate (CAGR), underscoring its commitment to increasing shareholder value. The next payout remains steady at an unchanged non-qualified $0.275 per share, with the record date recently passing on January 30 and the payment due on February 15.

This analysis aims to provide an in-depth look at the recommendation process, emphasizing Yield Attractiveness, Dividend Safety, and, to a lesser extent, Returns Potential and Risk. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on October 26, 2023.

By focusing exclusively on monthly payers, this piece promises a comprehensive exploration of how this eREIT stands as a beacon for monthly dividend investors seeking both growth and stability in their portfolios.