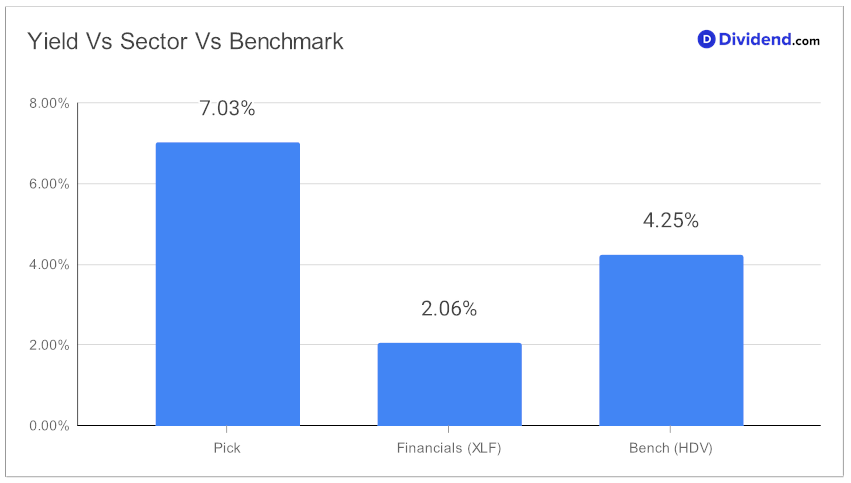

Are you a monthly dividend investor seeking a robust addition to your portfolio? Look no further than a mid-cap Business Development Company (BDC) that stands out in the realm of monthly dividend stocks. This company not only offers an impressive forward dividend yield of 7.03%, placing it in the top echelon of high-yield stocks, but it also excels in maintaining a careful balance between yield attractiveness and dividend safety.

What sets this stock apart? Its performance this year has been noteworthy, delivering a 20% return, aligning closely with the S&P 500 and outperforming the BDC industry average. For those keen on dividend consistency, the upcoming payout remains unchanged at $0.235 per share, going ex-dividend on December 7. This stability is a testament to the company’s financial health and strategic planning.

Our in-depth analysis delves deeper, providing insights into the nuanced selection process, which emphasizes not just yield and safety but also potential returns and risk management. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 3, 2023.

This meticulous approach is tailored specifically for monthly payers, ensuring that your investment aligns with both your income needs and risk profile. Stay tuned for a comprehensive exploration of why this BDC is a prime candidate for your monthly dividend portfolio.