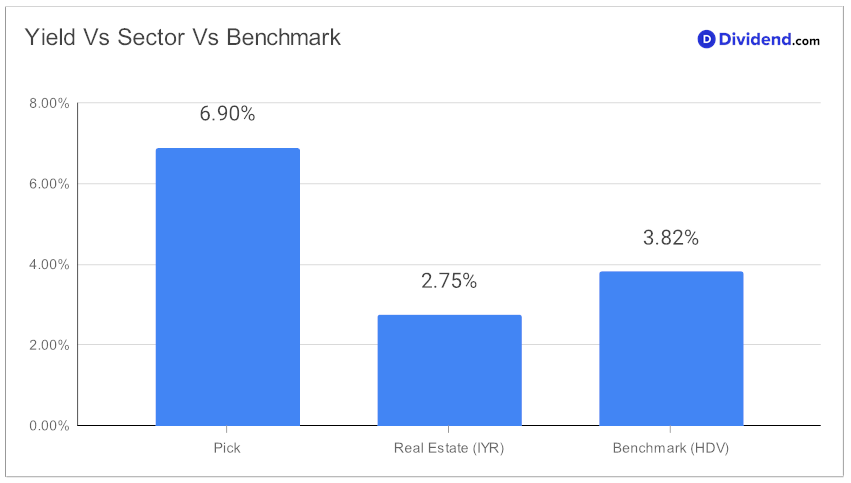

In the dynamic landscape of monthly dividend investing, a standout performer has recently been affirmed in the elite Best Monthly Dividend Stocks model portfolio. This mid-cap eREIT, known for its robust dividend offerings, showcases a forward dividend yield of 6.90%—a figure placing it in the top 20% of high-yield dividend stocks. Investors, however, are advised to be cautious of dividend traps, especially considering the eREIT industry average hovers around 5.4%.

The company’s dividend growth is equally impressive, with a 30% 3-year dividend per share compounded annual growth rate (CAGR), again ranking it in the upper echelons of all dividend stocks. For dividend enthusiasts, the next payout is particularly noteworthy: an unchanged non-qualified $0.275 per share, which went ex-dividend on December 28, with a payment date set for January 16.

This analysis is based on a rigorous recommendation process, optimizing for Yield Attractiveness and Dividend Safety, while also considering Returns Potential and Risk among monthly payers. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on October 26, 2023.

The in-depth stock analysis that follows will provide a comprehensive examination of this eREIT’s performance, offering insights into its sustained dividend success and potential investment opportunities.