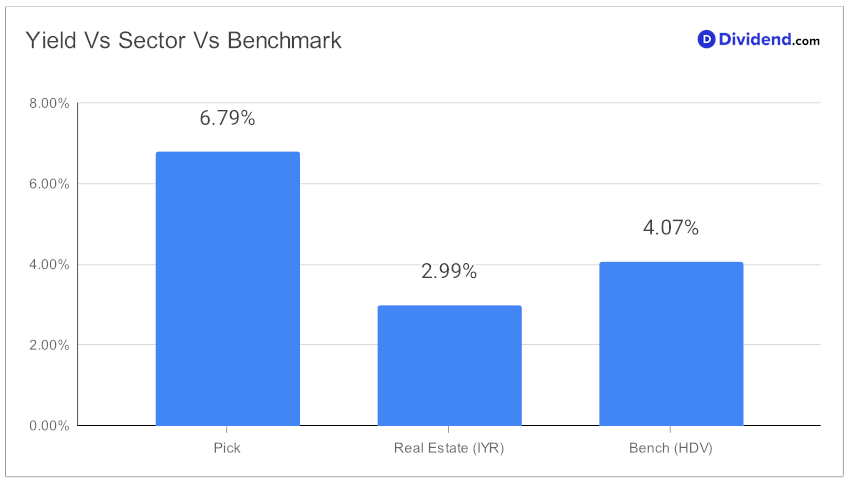

In the dynamic world of monthly dividend investing, a noteworthy mid-cap Business Development Company (BDC) has emerged as a stellar addition to the Best Monthly Dividend Stocks model portfolio. This BDC stands out with a forward dividend yield of 6.79%, placing it in the top 20% of high-yield dividend stocks. While the industry average hovers around 10.7%, investors are advised to be cautious of potential dividend traps.

Year-to-date, this stock has delivered impressive returns, outperforming both the S&P 500 and its industry peers with a 24% return compared to 22% and 21%, respectively. This performance highlights not only its yield attractiveness but also the potential for significant capital appreciation.

Investors should note the upcoming dividend payout. The company announced an unchanged dividend of $0.235 per share, which went ex-dividend on December 7, with a payment date scheduled for December 15. This consistency in payouts is a key factor for investors seeking reliable monthly income streams.

Our recommendation process prioritizes Yield Attractiveness and Dividend Safety, with a secondary focus on Returns Potential and Returns Risk, exclusively among monthly dividend payers. This inclusion is a testament to the company’s strong performance across these metrics. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 3, 2023.

The full stock analysis, which follows this teaser, dives deeper into the financials and future prospects of this high-performing BDC. It offers a comprehensive view for monthly dividend investors, combining critical insights with detailed analysis to guide your investment decisions.