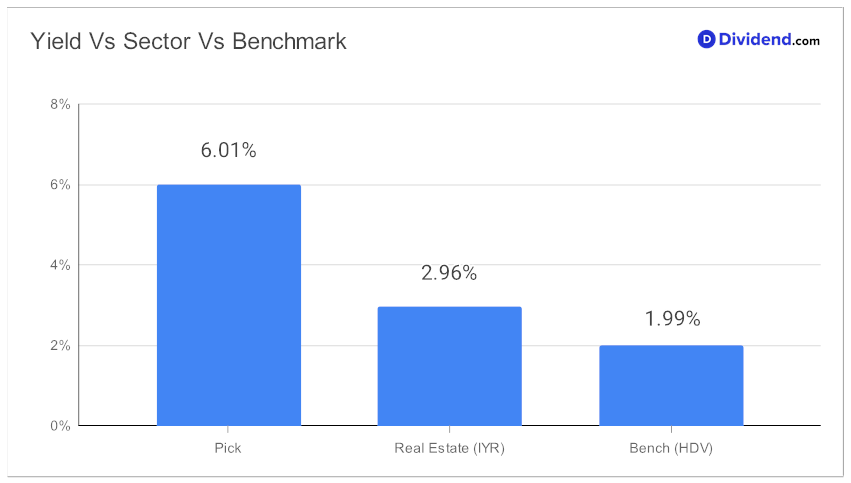

Are you on the hunt for a high-performing asset in the realm of monthly dividend stocks? If so, you might be interested in a well-covered mid-cap equity Real Estate Investment Trust (eREIT) that has proven its worth in terms of yield attractiveness and dividend safety. Its forward dividend yield stands at a significant 6.01%, positioning it in the top 20% of dividend stocks. To put this into perspective, the industry average yield for eREITs hovers around 5.7%.

Despite economic uncertainty, demand for leisure and business travel has been robust, helping the REIT see decent occupancy levels and report strong margins. Although the stock lags the S&P 500’s 17% gain on a YTD basis with its 2% gain, it beats the eREIT industry, which is down 1%.

Now, if you’re eager for the next payout, here’s some good news. A non-qualified dividend of $0.080 per share has just been declared and is scheduled to go ex-dividend next Thursday, September 28. It’s an unchanged amount, signaling a steady, reliable income stream for investors.

We also take into account the growth drivers and financial results discussed by the company management during their Q2 2023 earnings call held on August 5, 2023.

We dive deeper into the underlying factors contributing to this asset’s lucrative profile in our in-depth stock analysis that follows. There, we also discuss how it fares in terms of returns potential and returns risk, rounding off a comprehensive review for monthly dividend investors.