In the realm of monthly dividend investing, savvy investors are constantly on the lookout for reliable, high-yielding opportunities. One such opportunity, a well-established large-cap eREIT, stands out for its exceptional performance in the dividend stock market.

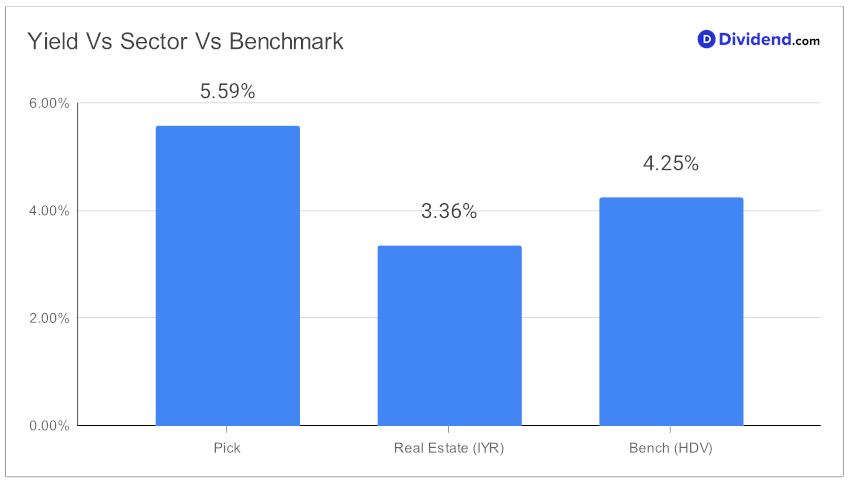

Boasting a forward dividend yield of 5.59%, it not only surpasses the eREIT industry average of 5.6%, but also ranks in the top 20% of dividend stocks, marking it as a high-yield investment. However, investors should be cautious of potential dividend traps in such high-yield scenarios.

What truly sets this eREIT apart is its impressive history of dividend increases. With a 30 +year track record of consistent dividend growth, it ranks in the top 10% of dividend stocks, signaling strong future prospects. The next payout, an unchanged non-qualified dividend of $0.256 per share, went ex-dividend on November 30 and is slated for a December 15 pay date.

Our recommendation process centers on optimizing for Yield Attractiveness and Dividend Safety, while also considering Returns Potential and Risk among monthly payers. This detailed approach ensures that only the most promising stocks make it into our Best Monthly Dividend Stocks model portfolio. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 8, 2023.

For those keen to delve deeper, an in-depth analysis follows, offering a comprehensive look at why this eREIT is a reaffirmed holding and a compelling choice for monthly dividend investors seeking both stability and growth.