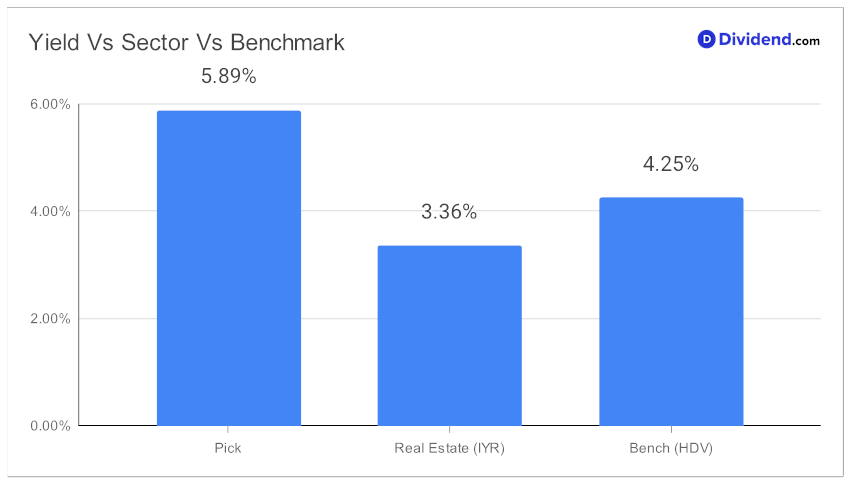

Investors seeking reliable monthly income have a compelling opportunity in a large-cap eREIT, notable for its robust dividend yield and remarkable track record. With a forward dividend yield of 5.89%, it outshines many in its league, ranking in the top 20% of high-yield dividend stocks. However, investors are advised to be cautious of potential dividend traps, as this yield closely mirrors the eREIT industry average of 5.9%.

Despite uncertainty in the real estate sector, the company has been able to maintain its acquisition spree to grow its business. Part of the reason comes down to its healthy balance sheet, giving it access to capital at relatively better terms compared to competitors, and its massive scale, enabling it to make larger acquisitions not feasible for its smaller rivals. The ability to further diversify its portfolio to seek additional growth opportunities is also seen as a positive factor.

What truly sets this eREIT apart is its impressive history of dividend increases. For 30+ years, it has consistently raised its dividends, placing it in the elite top 10% of dividend stocks. This trend is anticipated to continue, reassuring those focused on long-term income growth.

The next scheduled payout remains steady at an unchanged $0.256 per share, with the ex-dividend date having passed on October 31 and the pay date set for today, November 15. This stability in payouts reflects the eREIT’s commitment to shareholder returns.

Our comprehensive analysis delves deeper, evaluating the eREIT based on Yield Attractiveness and Dividend Safety, while also considering Returns Potential and Risk. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 8, 2023.

This holistic approach ensures that only the most promising monthly payers are recommended, aligning with the interests of discerning monthly dividend investors. Stay tuned for an in-depth exploration of this standout stock, where we uncover the nuances that make it a top contender in any dividend-focused portfolio.