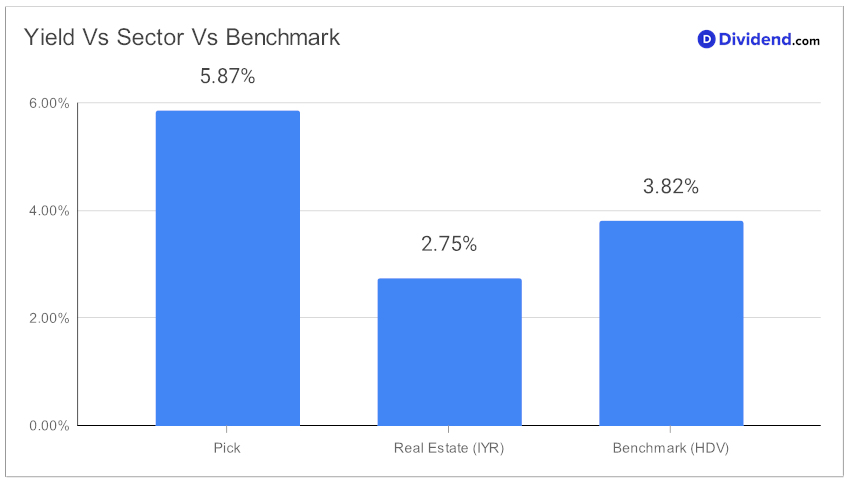

In the dynamic world of monthly dividend investments, a mid-cap eREIT has once again solidified its position in the highly regarded Best Monthly Dividend Stocks model portfolio. This recognition comes as a testament to its impressive performance metrics, which stand out in the realm of high-yield dividend stocks. Notably, it boasts a forward dividend yield of 5.87%, surpassing the eREIT industry average of 5.5% and placing it in the top echelon of dividend stocks. This high yield, coupled with a remarkable 188% three-year dividend per share compound annual growth rate, underscores its strength and consistency in delivering returns to investors.

The next payout, scheduled to go ex-dividend on January 30th, maintains its commitment to shareholder returns, with an unchanged non-qualified distribution of $0.080 per share. This announcement, made last week, reflects a strategic approach to dividend distribution, balancing yield attractiveness and dividend safety. It also subtly hints at the eREIT’s potential for return and the calculated risk involved in such investments.

Our in-depth analysis delves deeper into these aspects, unraveling the layers of strategy and financial acumen that place this eREIT in a position of prominence among monthly payers. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 9, 2023.

The article will offer insights into how this eREIT aligns with the broader investment goals of yielding consistent, safe returns while navigating the complexities of the real estate investment trust sector.