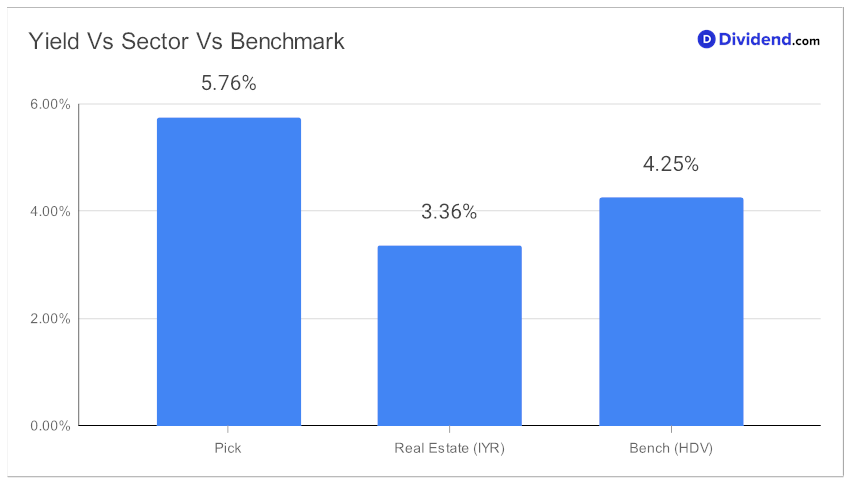

In the dynamic world of monthly dividend stocks, discerning investors perpetually seek out the cream of the crop. Among these, a certain mid-cap eREIT stands tall, not just for its robust 5.76% forward dividend yield but for its outstanding history of increasing payouts—a commendable 43% 3-year dividend/share CAGR.

This exceptional performer has not only eclipsed the eREIT industry average yield but has also delivered a solid 6% return YTD, bucking the industry’s downtrend and holding its own against broader market indices.

As we hone in on this eREIT, it’s worth noting the impressive balance struck between yield allure and dividend safety, a combination that resonates with the prudent monthly dividend investor.

With an upcoming payout maintaining its generous $0.080 per share, which recently went ex-div on the 30th of October, the pay date on the 15th of November is eagerly anticipated.

This teaser paves the way for an in-depth analysis that will unravel how this eREIT earns its place in the Best Monthly Dividend Stocks model portfolio. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 8, 2023.

Join us as we delve into the numbers, trends, and strategic positioning that mark this investment as a standout, ensuring its investors are well-positioned for consistent and reliable returns.