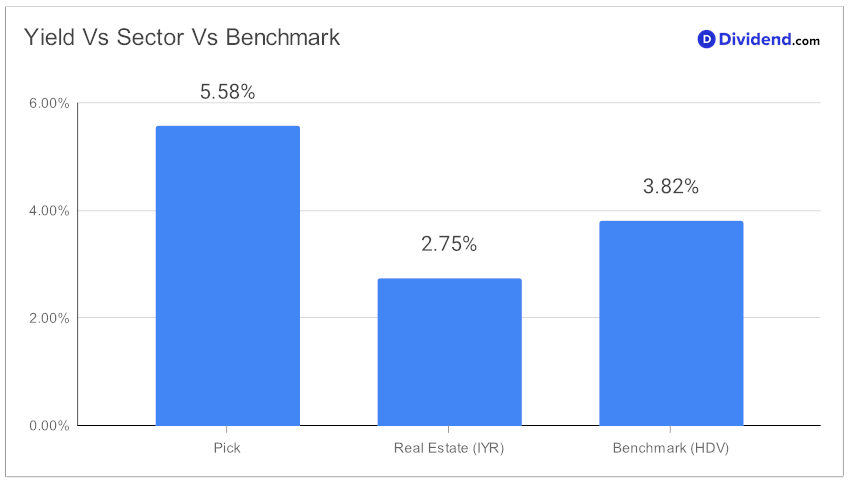

In the dynamic world of monthly dividend investments, one particular stock stands out, reaffirmed as a strong contender in the Best Monthly Dividend Stocks model portfolio. This well-established, large-cap eREIT has caught the attention of discerning investors, offering a forward dividend yield of 5.58%. This impressive figure not only surpasses the industry average of 5.5% but also positions it within the top 20% of high-yield dividend stocks. However, investors are advised to remain vigilant for dividend traps, given the high yield nature of this investment.

Further bolstering its appeal is the stock’s remarkable history of dividend increases, extending over 30 years. This consistent track record places it in the elite top 10% of dividend stocks, with expectations of continued growth in the future. Today, January 31st, marks a significant date for investors as the stock went ex-dividend, maintaining its payout at an unchanged rate of $0.257 per share. This payout is not only a testament to the stock’s stability but also a crucial consideration for investors seeking regular income.

The recommendation for this stock is not made lightly. It is the result of a meticulous process that prioritizes Yield Attractiveness and Dividend Safety, while also considering the potential for returns and associated risks, specifically among monthly payers. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 8, 2023.

As we delve deeper into this analysis, we invite readers to explore the intricate details that make this stock a noteworthy component in any monthly dividend investor’s portfolio.