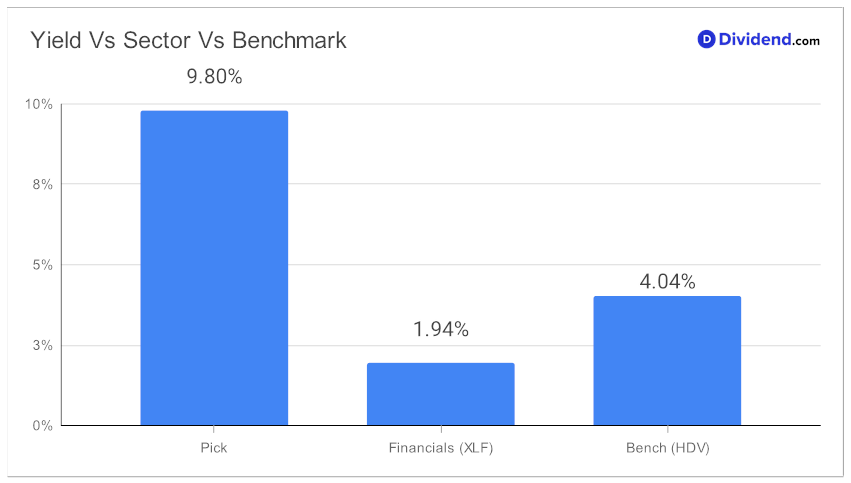

Are you a monthly dividend investor seeking to optimize your portfolio? We have an exciting addition to our Best Monthly Dividend Stocks model portfolio that you should consider. This thinly-covered small-cap BDC boasts a forward dividend yield of 9.80%, ranking it in the top 20% of dividend stocks. While this high yield is enticing, it’s crucial to be wary of potential dividend traps, especially as the BDC industry average is 10.9%.

Year-to-date, this stock has returned 5%, compared to 19% for the S&P 500 and 15% for the BDC industry. Despite these figures, the stock’s yield attractiveness and dividend safety make it a compelling choice.

What’s more, the company is set to payout a special non-qualified dividend of $0.020 per share, going ex-div today (Sep 6).

We also take into account the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on July 27, 2023.

Our recommendation process prioritizes Yield Attractiveness and Dividend Safety, while also considering Returns Potential and Returns Risk among monthly payers only.

Stay tuned for an in-depth stock analysis that follows, providing a comprehensive understanding of this new addition to our model portfolio.