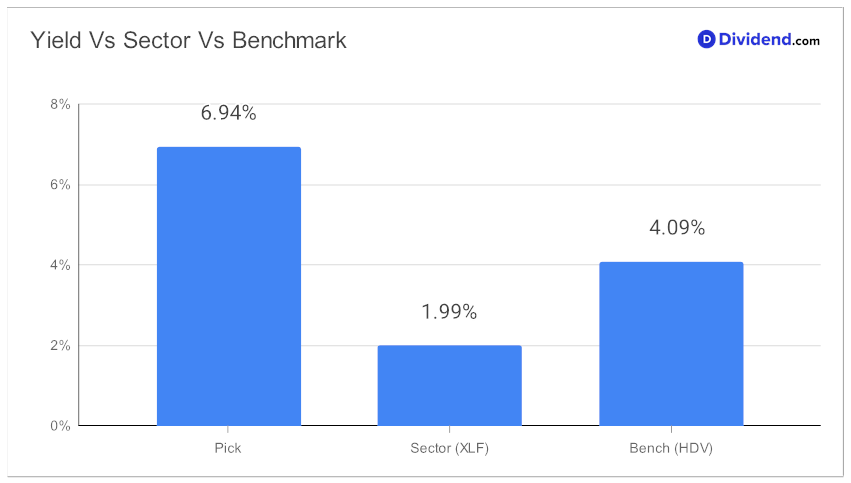

For monthly dividend investors seeking a robust addition to their portfolio, look no further than this well-covered mid-cap Business Development Company (BDC). With a forward dividend yield of 6.94%, it comfortably ranks in the top 20% of dividend stocks, offering a high yield that significantly outperforms the BDC industry average of 10.8%.

While high yields often raise concerns about dividend traps, the stability of this stock is reinforced by its remarkable 12-year track record of dividend increases—a feat that places it among the top 10% of dividend stocks. Future dividend increases are also anticipated, further solidifying its appeal.

Turning our attention to its Year-To-Date (YTD) performance, the stock has returned a respectable 10%. Although it trails behind the S&P 500’s 17% and the BDC industry’s 16%, its commitment to yield attractiveness and dividend safety makes it an attractive option for conservative monthly dividend investors.

For those keen on the next payout, mark your calendars for September 15. The company recently went ex-dividend on September 7 with an unchanged payout of $0.230 per share.

We also take into account the growth drivers and financial results discussed by the company management during their Q2 2023 earnings call held on August 4, 2023.

Our in-depth stock analysis, which follows this teaser, employs a stringent recommendation process.

The focus is primarily on Yield Attractiveness and Dividend Safety, and to a lesser extent, on Returns Potential and Returns Risk, tailored specifically for monthly payers. Make sure to delve into the comprehensive review for a deeper understanding of why this stock remains a compelling hold in our Best Monthly Dividend Stocks model portfolio.